First Peek at the 2002 Data MacroMonitor Marketing Report Vol. VI, No. 1 February 2003

What a difference a couple of years can make! In the 24 years that the MacroMonitor has tracked consumer financial attitudes and behavior, no two-year period has had as much turmoil in the financial markets, as much corporate malfeasance, and as many potential changes to the regulatory environment as the 2000–02 period had. But despite all these events and the resultant ebb in consumer confidence and trust in the financial markets, what is most striking about our first look at the new MacroMonitor data (3,773 respondents collected from May through October 2002) is that most of the meaningful movements in financial-product ownership or use are in the expected directions. Moreover, most of our behavioral measures have not changed in statistically significant amounts.

But this apparent lack of movement on the surface frequently hides underlying turmoil among different demographic segments. Notable observations include the following:

The results of our 2002 MacroMonitor survey on household income and assets align with the recently released 2001 Survey of Consumer Finances by the Federal Reserve. That is, the net worth of the wealthiest U.S. households showed the biggest jump in median values. Unlike the past decade, when the rising tide of affluence lifted all ships, the past couple of years were notable for lifting fewer ships. In fact, one of the most striking facts about the new data is that the gap between the affluent and the rest of the market continues to grow.

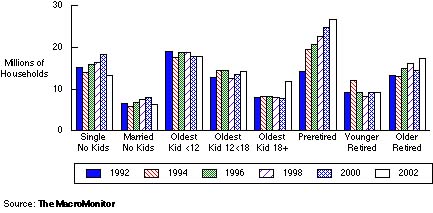

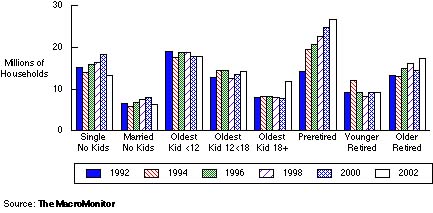

LIFE STAGES: DECLINE IN NEW HOUSEHOLD FORMATION

Our Life Stage approach to the financial-services market successfully anticipated the impact and clearly explains the changes evident above. The economic turmoil of the past two years has put a damper on the household-formation trend of the past decade. Both single households and new couples (with no children) have decreased in number. At the same time, the proportion of households in which a child 18 years old or older is present has increased significantly—an impact of a decline in job opportunities and the increased debt levels that inhibit household formation and foster a return of the "boomerang" phenomenon of a decade ago. Significant growth continues in the preretired life stage as the Boomers end their child-rearing responsibility and prepare for retirement. At the same time, many people who might have retired have chosen (where they had a choice) to remain employed to increase their savings and put off the day when they start drawing their retirement balances down. Retired households headed by someone older than 70 years have increased in number as people continue to live longer. (Later this year we will explore the redefinition of retirement life stages as we create a baseline for measuring the potential for financial providers to create new financial products and services as these stages evolve and the Boomers begin to inhabit them.)

Which households saw their incomes, liabilities, and assets increase or decrease depends on several variables, including demographics, life stages, household responsibilities and obligations, goals, willingness to take risks, and other attitudinal factors. The analysis of all these different indicators will be the subject of forthcoming client reports, presentations, and ancillary analysis as MacroMonitor analysts present the details of the current state of consumer financial attitudes and behavior.

But this apparent lack of movement on the surface frequently hides underlying turmoil among different demographic segments. Notable observations include the following:

- Decline in new household formation. Single households and new couples with no children have decreased in number. At the same time, the proportion of households with a child 18 years or older present has increased significantly—likely a direct result of decreased job opportunities and debt levels that inhibit household formation.

- Retrenchment in ownership of salary-reduction plans (401(k), 403(b), 457). Although overall penetration of retirement accounts continues to grow, the incidence of salary-reduction plans (SRPs) stopped its consistent growth pattern. Two demographic segments likely account for this reversal. First, younger households in the earlier life stages that would otherwise have initiated SRP participation may have forgone this option in the current economic environment. The second group includes the nearly 3 million households in which people have lost jobs in the past two years. Many of these people may be unwilling early retirees who have rolled over their SRP assets into IRAs.

The results of our 2002 MacroMonitor survey on household income and assets align with the recently released 2001 Survey of Consumer Finances by the Federal Reserve. That is, the net worth of the wealthiest U.S. households showed the biggest jump in median values. Unlike the past decade, when the rising tide of affluence lifted all ships, the past couple of years were notable for lifting fewer ships. In fact, one of the most striking facts about the new data is that the gap between the affluent and the rest of the market continues to grow.

Our Life Stage approach to the financial-services market successfully anticipated the impact and clearly explains the changes evident above. The economic turmoil of the past two years has put a damper on the household-formation trend of the past decade. Both single households and new couples (with no children) have decreased in number. At the same time, the proportion of households in which a child 18 years old or older is present has increased significantly—an impact of a decline in job opportunities and the increased debt levels that inhibit household formation and foster a return of the "boomerang" phenomenon of a decade ago. Significant growth continues in the preretired life stage as the Boomers end their child-rearing responsibility and prepare for retirement. At the same time, many people who might have retired have chosen (where they had a choice) to remain employed to increase their savings and put off the day when they start drawing their retirement balances down. Retired households headed by someone older than 70 years have increased in number as people continue to live longer. (Later this year we will explore the redefinition of retirement life stages as we create a baseline for measuring the potential for financial providers to create new financial products and services as these stages evolve and the Boomers begin to inhabit them.)

Which households saw their incomes, liabilities, and assets increase or decrease depends on several variables, including demographics, life stages, household responsibilities and obligations, goals, willingness to take risks, and other attitudinal factors. The analysis of all these different indicators will be the subject of forthcoming client reports, presentations, and ancillary analysis as MacroMonitor analysts present the details of the current state of consumer financial attitudes and behavior.