2004: A New Order MacroMonitor Marketing Report Vol. VI, No. 4 August 2003

We have weathered several years of significant change and upheaval. The economy has gone through another cycle. Markets have bounced off their bottoms and are rebounding. Regulatory agencies and the judicial system are addressing corporate abuses in financial reporting and conflicts in investment advice. Financial institutions are weighing the impact of changes in taxes and tax-advantaged instruments on their business while financial advisers devise new recommendations for their clients. Consumers are slowly beginning to understand the price they must pay for their past mistakes and misjudgments. To move forward in this changed and evolving environment, financial providers will need to understand how, when, why, and which consumers will react to what parts of the new order.

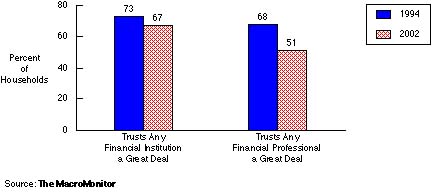

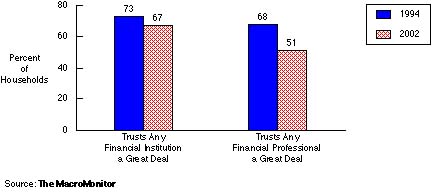

TRUST IN FINANCIAL INSTITUTIONS AND PROFESSIONALS

Among the questions and issues that every financial institution should be contemplating as they plan for 2004 and into the future are the following:

Among the questions and issues that every financial institution should be contemplating as they plan for 2004 and into the future are the following:

- Are we headed toward deflation? Let's hope not. But if it does happen, how will it affect consumers' buying behavior? And more critical for financial providers, how will it affect consumers' use of financial services?

- What do investors want now? Is the market back? Will it continue to go up? How has investor behavior changed? Will investors return to day trading and blindly buy every IPO and everything their broker suggests? What will they buy?

- Got debt? You bet! And not just equity-based debt. Credit-card outstandings, education loans, and many other forms of consumer debt are increasing even as people say that they want to pay down their debts. Few are succeeding in doing so. And higher levels of debt are creeping into the Preretired and Retired Life Stages.

- Will the housing boom continue? Not likely as equity levels in homes reach new post-WWII lows and interest rates start rising from their GI Bill levels. Where will providers who have profited from the equity boom find their profits and growth?

- How to convince people that they need all types of insurance: life, health, property, and casualty? How to balance a level of insurance that is appropriate for consumers with intermediaries' desire to sell and institutions' need for growth? What can reinvigorate, reinvent, and restore this essential industry?

- What is the impact of the recent tax changes? By applying the lessons from the Tax Reform Acts of 1986 and 1994, the MacroMonitor can determine which consumers will react to the current (and proposed) changes and what they are likely to do.

- Direct marketing's burden: What is the impact of the Do-Not-Call list? Has "spam" ruined the Internet for direct marketing? At what point do the inundation of mail pieces and declining response rates make direct mail too expensive?

- Online banking and electronic bill presentment and payment: If they are successful and the number of users continues to increase, what other transaction media will suffer? Who are the early adopters and how fast are they adopting?

- With 30% of all households, regardless of their Life Stage, having nothing saved for retirement, more people will inevitably continue to work into their sixties and beyond. The MacroMonitor identified new upcoming Life Stages of Revolving Retirement and Postretirement.