KISS: Keep It Short and Simple MacroMonitor Marketing Report Vol. VI, No. 5 October 2003

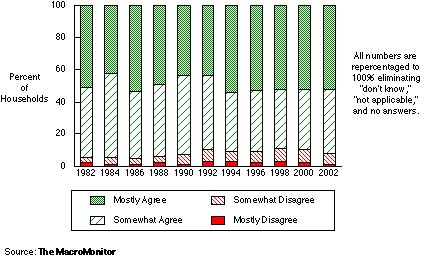

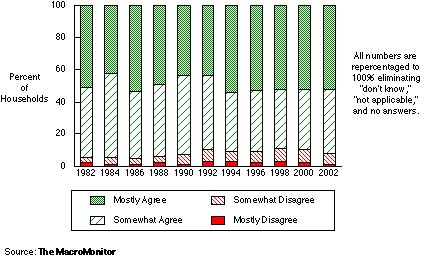

One of the most pervasive consumer financial needs that financial providers have yet to meet is the universal desire for simplicity. In the two decades that the MacroMonitor has measured this need, the vast majority of U.S. households have consistently expressed a strong preference for their financial affairs to remain uncomplicated.

I LIKE TO KEEP MY FINANCIAL AFFAIRS UNCOMPLICATED

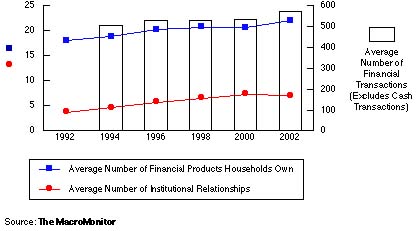

Yet financial providers continue with their unrelenting drive to convince consumers to buy their products and services, encouraging people to obtain their additional offerings with no regard for the products and services that consumers already own. In the past decade we have seen growth in a number of vehicles—including credit cards, debit cards, ATM machines, and automatic transactions via telephone, computer, or payroll deposits and deductions—to capture consumers' transactions. Paralleling this growth is the successful introduction of the middle class into investing and the accompanying increase in ownership of stocks and mutual funds, both inside and outside retirement accounts. In addition, we see the increase in home ownership and the use of collateralized credit instruments. The MacroMonitor data trends in the figure below highlight the decade-long growth in the number of transactions, financial products owned, and relationships with different financial institutions by U.S. households.

TRANSACTIONS, PRODUCT OWNERSHIP, AND INSTITUTIONAL RELATIONSHIPS

In the 24/7 world we live in, time never seems to be sufficient to do everything we need, want, or hope to do. If the trends in use of financial-services products continue on their upward trajectory, people are going to start running up against the limits of time they are willing to spend on their financial affairs. Inevitably, consumers will be looking for a trusted financial relationship to simplify and consolidate their finances.

This MacroMonitor report makes the case for the need for financial providers to respond to consumers' desire for simplification and offer strategies that financial institutions can undertake if they want to be ahead of the curve of this trend.

By delivering on the decade-old promise of simplicity, with a newer promise of giving customers more time for the other parts of their lives, financial-services providers can gather more of their financial products and services and ensure that their institution will be one of the survivors.

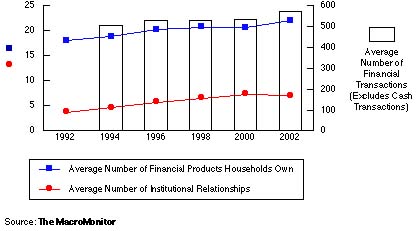

Yet financial providers continue with their unrelenting drive to convince consumers to buy their products and services, encouraging people to obtain their additional offerings with no regard for the products and services that consumers already own. In the past decade we have seen growth in a number of vehicles—including credit cards, debit cards, ATM machines, and automatic transactions via telephone, computer, or payroll deposits and deductions—to capture consumers' transactions. Paralleling this growth is the successful introduction of the middle class into investing and the accompanying increase in ownership of stocks and mutual funds, both inside and outside retirement accounts. In addition, we see the increase in home ownership and the use of collateralized credit instruments. The MacroMonitor data trends in the figure below highlight the decade-long growth in the number of transactions, financial products owned, and relationships with different financial institutions by U.S. households.

In the 24/7 world we live in, time never seems to be sufficient to do everything we need, want, or hope to do. If the trends in use of financial-services products continue on their upward trajectory, people are going to start running up against the limits of time they are willing to spend on their financial affairs. Inevitably, consumers will be looking for a trusted financial relationship to simplify and consolidate their finances.

This MacroMonitor report makes the case for the need for financial providers to respond to consumers' desire for simplification and offer strategies that financial institutions can undertake if they want to be ahead of the curve of this trend.

By delivering on the decade-old promise of simplicity, with a newer promise of giving customers more time for the other parts of their lives, financial-services providers can gather more of their financial products and services and ensure that their institution will be one of the survivors.