MacroMonitor Market Trends September 2012

MacroMonitor Market Trends is a newsletter from Consumer Financial Decisions (CFD) that highlights topical news and trends of interest to you and your colleagues. If you would like more information about the topic in the newsletter or would like to discuss other ways that we can assist you in your research or marketing efforts, please contact us.

Welcome to the Age of Revolving Retirement!

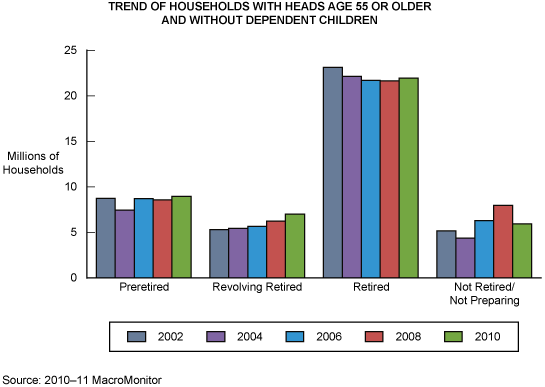

CFD first reported impending changes in retirement (Redefining Retirement) in May 2001. The combination of trends in demographics, two-earner households, increased life expectancy, and low savings rates pointed to a shift in the role of retirement in society and introduced a new life stage: Revolving Retirement. For many people, retirement would no longer take place at a "fixed" age (65), with households accumulating wealth before and living on wealth disbursement after an exit from the workforce. Instead, as a result of choice or necessity, the new life stage exhibited some traits of both preretired and retired households. As CFD predicted and the graphic below illustrates, the number of Revolving Retired households is growing.

In 2002, when we created questions to identify Revolving Retired households, few indications suggested that economic conditions would speed the growth in the number of Revolving Retired households. At the time, other indications did exist, such as one household head waiting for his or her spouse to retire or people downshifting from full-time to part-time or freelance work. Hobbies and volunteer activities would become fulfilling passions while generating enough income to live on or to supplement savings. Households that had not saved enough to retire fully could continue to build assets or improve their lifestyle in retirement.

Economic conditions since the Great Recession of 2008 have increased the necessity of Revolving Retirement for many households. The recession has forced more Boomers (and even some older households) to delay retirement or return to the workforce. The incidence of Revolving Retired is increasing and is doing so more quickly than anyone anticipated. Because of continuing economic uncertainty and many households' feelings of vulnerability, the number of Revolving Retired will likely continue to grow in 2012. Because the residual effects of the recession will last for some time, when these households will transition to traditional retirement is unclear.

Revolving Retired households are at the peak of their asset-accumulation years. They are very likely to make significant changes in the assets they own, the institutions they use, and the financial professionals on which they rely. Many of the products and services that developed during the one-household, one-income and defined-benefit-plan era are ill suited to the needs of the Revolving Retired. Financial institutions (and professionals) that understand the evolving needs of Revolving Retired households better and that provide them the means to traverse this new life stage stand the best chance to profit.

MacroMonitor sponsors may access a Segment Summary about Revolving Retired on Strategic Business Insights' CFD website. Sponsors may request a customized full presentation on the Revolving Retired. In addition, you may view a mini-presentation about Revolving Retired.

To learn more about the Revolving Retired or other segments of interest, please contact CFD.