MacroMonitor Market Trends February 2013

MacroMonitor Market Trends is a newsletter from Consumer Financial Decisions (CFD) that highlights topical news and trends of interest to you and your colleagues. If you would like more information about the topic in the newsletter or would like to discuss other ways that we can assist you in your research or marketing efforts, please contact us.

Welcome Millennials (1977–94)

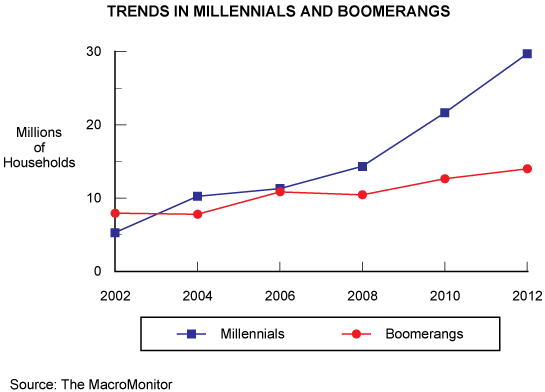

The youngest members of the next generational cohort—Millennials—have turned 18. Increasingly their presence will be evident in the marketplace as they embark on life's path: Financial tools will become ever more important. The number of Millennial-headed households has grown from about 5 million in 2002 to nearly 30 million in 2012. Because of the past decade's two recessions and the continued dampened economic environment, Millennials are forming independent households at a slower rate than did Gen X and Baby Boomer cohorts. For economic reasons, many Millennials (even some with a college degree) are returning home to live with parents—a Boomerang phenomenon.

Unlike previous cohorts anxious to establish their independence, Millennials are much less likely to move out of their parents' homes. Many enjoy a friendly relationship with parents and have been raised with an unprecedented level of familial emotional and economic support; overall, Boomer parents are less likely than their own parents were to cut financial ties. In fact, about one in ten Millennial-headed households require financial assistance. However, extended adolescence can't last forever. MacroMonitor data for 2012–13 show that household and family formation increases for Millennials by their late twenties, at which point 48% of have children. As the economy improves and more Millennials become financially independent, the pace of those on life's traditional path will escalate. More Millennial-headed households will then require financial tools beyond checking and savings accounts. Financial-services providers appear to be tepid about wooing these households. A reasonable effort to attract Millennial-headed households now will prevent more expensive acquisition efforts in the future. Organizations that are ultimately successful with Millennials will need to learn how to provide new value—such as customizable product features, instant access, and seamless delivery across channels—to attract the next generation of customers.

MacroMonitor sponsors may access insights about Millennials in the February 2013 Segment Summary available from your company's SBI/CFD landing page. Sponsors may request a full presentation about Millennials, including a customized and proprietary Q&A session. Segment Summaries about populations of particular interest to your organization—for example, retirees with excess income, Asians, mutual-fund investors, debit-card users, and the Emerging Affluent—are available on request. To learn more about the Millennials or for answers to questions, please contact us.