MacroMonitor Market Trends Newsletter November 2013

The MacroMonitor Market Trends Newsletter from Consumer Financial Decisions (CFD) highlights topical news and trends of interest to you and your colleagues.

Revisiting Redefined Retirement, Postrecession

Many potential retiree households have a problem: how to afford to retire. The situation is not a surprise to demographers and societal observers, but it appears to have caught many government agencies, financial regulators, and financial-services providers unaware. Recent media reports about the retirement problem are the result of the situation's near-crisis proportion. High-asset households with heads ages 55 and older can afford to retire successfully—though a smaller portion have high assets than previously. Some households are retired not by choice but because the household head has lost his or her job because of the recession and is of an age when finding another in a sluggish economy is extremely difficult. But the average household has less than $100 000 in savings and investments and plans to rely on Social Security for most of its retirement income. The only available (short-term) solution for average households is to continue to work—working into one's sixties and seventies is now common. These households are the most likely to become Revolving Retired. Revolving-Retired households are those with a primary head age 55 or older who has gone from full-time to part-time work, retired and returned to the workforce, or retired and plans to return to the workforce.

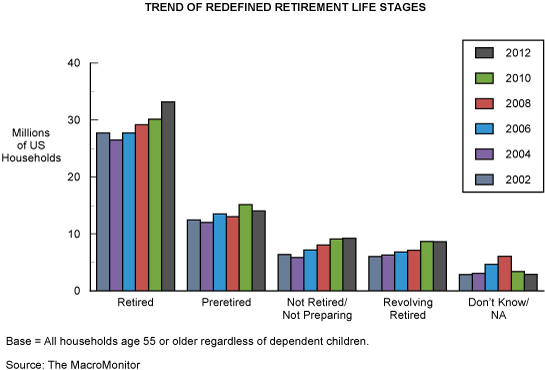

After increasing in each wave in the past decade, the number of Revolving-Retired households remains the same in 2012. The incidence of households with heads age 55 and older who have retired increased significantly in 2012—likely the result of the more affluent Older Boomers. Whether these households remain retired and whether succeeding Boomers are sufficiently flush to afford retirement remain questions. Some Revolving-Retired households, as well as households preparing for retirement, continue to support dependents; households with dependent children no doubt postponed forming families in their thirties. The continuing growth of households with heads age 50 and older who are not retired and not preparing to retire and the decline in households that don't know what their retirement status is are chapters in the story of diminished (or destroyed) retirement expectations.

A gap exists between the products and services that financial institutions offer to preretired and retired households and the needs of Revolving-Retired households. As retirement evolves into a more flexible yet complicated life stage, financial-services providers could benefit from understanding the multiple stages of retirement better.

Not only has the breadth of financial needs of retirement-age households expanded, but age itself is no longer an accurate predictor of when needs occur. The MacroMonitor has been tracking retirement life stages and households' needs for over a decade.

If this market segment is important to your business:

MacroMonitor subscribers may request a package of custom, edited data tables and charts that profile Preretired, Retired, and Revolving-Retired households.

In addition, from their CFD client-landing page, subscribers may:

- Access the November 2013 Segment Summary, Revolving-Retired Households.

- Download the November 2013 Dirty Dozen—a dozen annotated graphic-analysis slides that pertain to retirement.

- View Quick Stats for US Economic Household and Revolving-Retired Household definitions and a chart of households in each population from 2002 through 2012.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.

If you are not a MacroMonitor subscriber but would like more information about Revolving-Retired households, please contact us for package information and pricing.