MacroMonitor Market Trends Newsletter April 2014

The MacroMonitor Market Trends Newsletter from Consumer Financial Decisions (CFD) highlights topical news and trends of interest to you and your colleagues.

Boomers Retirees Contribute to Deflation

The United States faces a "demographic cliff," according to author Harry Dent. Between 2014 and 2019, many Older Boomers will retire, and relatively few young families (Millennials) will enter earning and spending life stages. Dent refers to this period as "the great deflation"; he predicts that, on the basis of demographics alone, the economy won't shift back to growth until about 2023.

The ability of Older Boomers (currently between the ages of 61 and 68) to retire depends on more than assets and liabilities (see the March 2014 MacroMonitor Market Trends Newsletter). For the majority of households, retirement is also dependent on sufficient cash flow—reliable sources of income—and modest fixed expenses. As Boomers cut spending in order to live on a fixed income, many of the "best" US consumers will all but disappear. The number of transactions, the need for credit, and the ability to save or invest, for example, will not grow. In fact, the number is quite likely to decline.

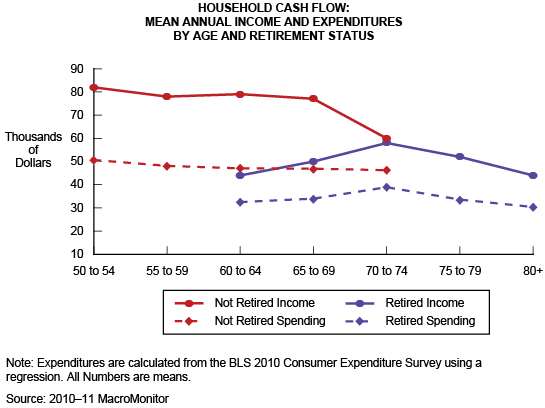

As retirement shifts from the line-in-the-sand event for the Silent and Greatest Generations to a transitional stage lasting ten years or more, Older Boomers will split into two groups: People who can afford to retire at the official retirement age and people who cannot afford to do so. Income for nonretired and retired households differs greatly for households with heads (HHHs) in their sixties and younger, in comparison with retired households with heads of the same age. The household-income gap between nonretired and retired households disappears when HHHs reach their early seventies. However, household spending is consistently lower for retired households than for nonretired households—households that are not currently retired will be reducing expenditures.

Households that do retire are presumably more confident about their income than are households that do not retire. Over three in five Older Boomers household heads are focused on the ability to live on a fixed income. Slightly more than three in five (net) agree they will rely on Social Security for their retirement. Fewer than two in five are 100% vested in a defined-benefit pension plan.

Because of the impact of the recent recession and deflation, market uncertainty, and risk aversion, the rote prescription for retirement no longer applies. The Boomers represent the vanguard of a split. More Older Boomers than Younger Boomers were positioned to take advantage of the stock and real estate markets in the 1970s and 1980s; they are also more likely to have pensions. Many of these households will be able to retire in relative comfort and security. Overall, Younger Boomers have fewer assets and pensions and more debts than do Older Boomers; more of these households than previously will struggle to reduce spending and live on fixed income. As a result, retailers and financial-services providers will be challenged to make up profit shortfalls. As the meaning of retirement changes, modern retirees will be challenged to find products and providers that will specifically serve their retirement needs.

If this market segment is important to the future of your business:

MacroMonitor subscribers may request a package of custom, edited data tables and charts that profile nonretired and retired households.

In addition, from their CFD client-landing page, subscribers may:

- Access the April 2014 Segment Summary, Recently Retired Households.

- Download the April 2014 Dirty Dozen—a dozen annotated graphic-analysis slides that pertain to Older Boomers and retirement.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.

If you are not a MacroMonitor subscriber but would like more information about nonretired and retired households, please contact us for package information and pricing.