MacroMonitor Market Trends Newsletter June 2014

The MacroMonitor Market Trends Newsletter from Consumer Financial Decisions (CFD) highlights topical news and trends of interest to you and your colleagues.

Generation X Is Not As Homogeneous As You Might Think

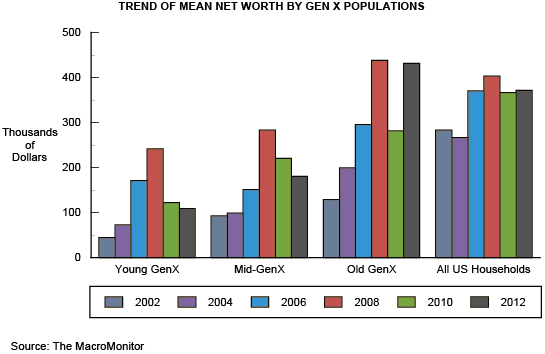

Generation X—people born between 1963 and 1976—are often "the most educated generation." However, as an age cohort, they are not as homogeneous as this description suggests. Dividing Gen Xers into three age segments allows important differences within the cohort to become apparent. Oldest Gen X household heads are born between 1963 and 1968; middle Gen X heads are born between 1969 and 1972; the youngest Gen X heads are born between 1973 and 1976. In 2012, the oldest Gen Xers have almost regained their prerecession net worth; mid- and young Gen Xers continue to experience a decline.

During the 1990s, the United States saw the longest sustained economic growth in history. During this period, many older Gen Xers capitalized on this growth; the youngest Gen Xers were age 17 and younger in 1990. After 2008, Gen X households experienced a significant reduction in their net worth (see the December 2013 MacroMonitor Market Trends Newsletter), but losses were uneven, depending on the age of the household head.

Generation X households are in the prime of their financial lives and therefore use a diverse range of financial products and services. The data suggest that a one-size-fits-all strategy for Gen X households is not the best choice; financial services that speak to unique situations by age of the household head would be more profitable. For example, mid- and young Gen X households will work to recoup losses from 2008 at the same time that older Gen X households focus on retirement readiness.

To market effectively to the needs of Generation X households, financial-services companies must understand the different needs of the three distinctly different age segments first. The oldest Gen Xers behave similarly to younger Baby Boomers. They are most likely to be planning for retirement; their financial behaviors indicate they are doing so. In an economic climate with fewer well-paying jobs than existed in prerecession times, middle and younger Gen X heads must focus on shoring up their emergency-savings funds and diversifying their insurance portfolio (such as disability and income-protection-insurance products) and—for households with children—contributions to an education-savings plan.

If this market segment is important to the future of your business:

MacroMonitor subscribers may:

- Access the June 2014 Segment Summary, Gen X Differences.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.

If you are not a MacroMonitor subscriber but would like more information about Generation X, please contact us for package information and pricing.