MacroMonitor Market Trends Newsletter November 2014

The MacroMonitor Market Trends Newsletter from Consumer Financial Decisions (CFD) highlights topical news and trends of interest to you and your colleagues.

Apple Pay Is a Game Changer

The new iPhone 6 and iPhone 6 Plus that Apple introduced in September 2014 resulted in the usual media frenzy and consumer rush to purchase that Apple's introductions engender; consumers ordered 4 million units in the first 24 hours after the phones became available, and sales during the first weekend after launch topped 10 million units globally (excluding China). Although Apple's record-topping phone debut assures Apple of robust fourth-quarter holiday sales, the larger story is about Apple Pay—the ability of iPhone 6 users to pay for purchases at the register using their smartphone and fingerprint. Once again, Apple is right on target to appeal to its most devoted fans with a compelling application: more secure transactions with a promise of speedy checkout and no paper receipts.

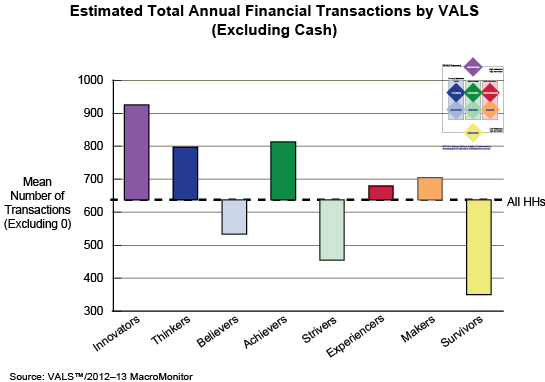

This special-edition newsletter uses Strategic Business Insights' (SBI's) VALS™ to bridge data sets between the 2012–13 MacroMonitor and spring 2014 GfK Mediamark Research to compare Apple iPhone owners with high, noncash financial transactors. Slightly more than one-quarter of US adults own an iPhone. However, 46% of VALS Innovators and 45% of Achievers own an iPhone, according to GfK MRI data. These same two groups conduct the highest estimated number of total annual noncash transactions: 925 transactions by Innovators and 813 transactions by Achievers, according to the 2012–13 MacroMonitor. The majority of both Innovators and Achievers are concerned about security and privacy. Apple reportedly plans not to collect personal information about Apple Pay transactions and eliminates the need for a third party—such as a retailer—to see or handle users' credit-card numbers.

Unlike Google Wallet and the mobile version of PayPal, neither of which has gained widespread acceptance, Apple Pay has a ready and receptive target market. However, don't expect Google or PayPal (which recently spun off from eBay) to sit back and allow Apple to dominate mobile payments without a fight. SBI's Explorer analysts anticipate that in the near future Google will improve Google Wallet, perhaps via use of fingerprints or voiceprints.

If mobile payments are important to the future of your business:

MacroMonitor subscribers may:

- Download a special VALS-based CFD Executive Report, Money Revolution.

- Schedule a full presentation about mobile payments, including a customized and proprietary Q&A session. Contact us to schedule your presentation.

If you are not a MacroMonitor subscriber but would like more information about mobile payments, please contact us for package information and pricing.