MacroMonitor Market Trends Newsletter October 2015

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Stock Market Volatility and Investors' Trust

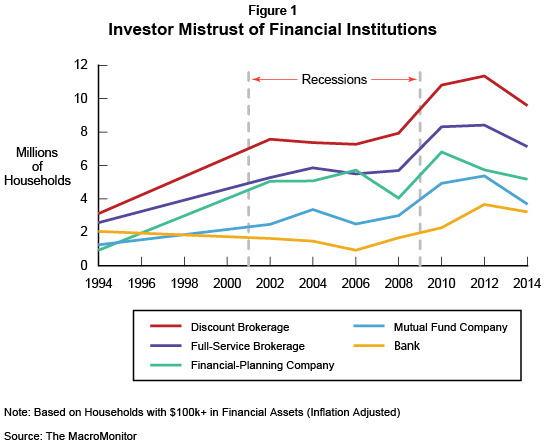

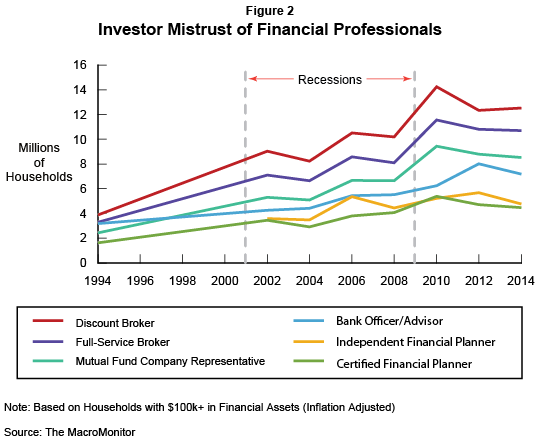

Recently, volatility in the stock market has returned to levels last evident in September 2008 at the start of the past recession. Repeated market volatility produces more changes than simply in the amount of a household's invested assets; it changes how investors think, feel, and behave about their investments. The two most recent recessions (2000–01 and 2008–09) show clearly that even when the US stock markets recover, investors' trust in financial institutions and professionals rarely returns to prerecession levels—investor mistrust simply increases with time.

Households mistrust discount brokerages the most. However, full-service brokerages and banks are not immune to an increasing lack of trust; financial-planning companies and mutual fund companies fare only marginally better. Brokerages and banks, in particular, focus on households with high investable assets. From the consumer point of view, this single focus (which does not consider the households' total financial picture) engenders only greater mistrust.

The prevailing view in the investment community has been that most investors will blindly follow their financial professional to another institution should their broker switch, should the institution fail to meet portfolio expectations, or should the institution participate in a bothersome scandal. In fact, a growing number of investors do not share this view. Because the number of very high-net-worth investors is finite, many lower-net-worth investor households no longer have a personal relationship with a single financial professional or may not have a designated financial professional at all: They use call centers, online portals, and—most recently—robo-advisors. The result is that more households mistrust financial professionals than mistrust financial institutions. Financial planners are the exception because their recommendations and services build personal relationships with their customers through a review of—and suggestions for—the household's complete financial needs.

Current market volatility reminds investors daily of the recent recessions. Consequently, investment firms—if they continue to behave as if nothing is different and do not alter their approach to investors to consider the complete needs of these desirable households—run the risk of further alienating their customers and losing their business forever. To find out more about investor households than simply their investable assets, contact CFD.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Access the October 2015 Segment Summary, Investor Mistrust.

- View the October Quick Stats Trends: Investor Mistrust of Financial Institutions and Professionals

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact Us to schedule your presentation.