MacroMonitor Market Trends Newsletter April 2016

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Financial Personalities: How Much Influence?

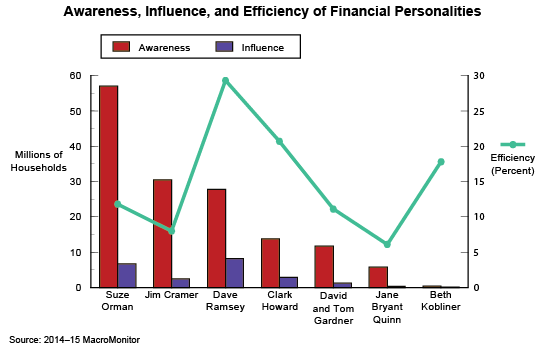

Financial personalities are everywhere, talking, shouting, preaching, or maybe just informing consumers about what they are doing wrong and about what they should be doing right. Do these outsize personalities have any effect? Do people actually listen and follow their suggestions? In 2014, the MacroMonitor measured the awareness and influence of seven well-known financial personalities followed by a question: "In the past two years, which of the following influenced you or anyone in your household to obtain a financial product or service or to change your financial behavior?" Awareness and efficiency—the ratio of influenced households divided by households that are aware—are shown below.

Suze Orman's ubiquitous advice programs top the awareness list with 57 million households, followed by Mad Money's Jim Cramer with 30 million households. Nearly 28 million households have heard of Dave Ramsey and his Financial Peace University, 14 million households are aware of Clark Howard (The Money Coach), and 12 million households are aware of David and Tom Gardner (The Motley Fool). However, the numbers of households that have taken any action on the basis of the advice of these personalities in the past two years are modest: Dave Ramsey (8.1 million households), Suze Orman (6.7 million households), Clark Howard (2.8 million households), and Jim Cramer (2.4 million households).

Efficiency rankings for the personalities look completely different. Dave Ramsey is the most effective, with a ratio of nearly 30%, followed by Clark Howard with a ratio of 21%. Although less well known than other personalities, Beth Kobliner (Get a Financial Life: Personal Finance in Your Twenties and Thirties) scores particularly well with an efficiency ratio of 18%.

The April Segment Summary, Who Responds to Financial Personalities?, highlights demographics, financial balance sheet, institutional use, and financial attitudes of households that respond to financial personalities.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Access the April 2016 Segment Summary, Who Responds to Financial Personalities?

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.