MacroMonitor Market Trends Newsletter February 2018

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Employee Benefits: Offered versus Used

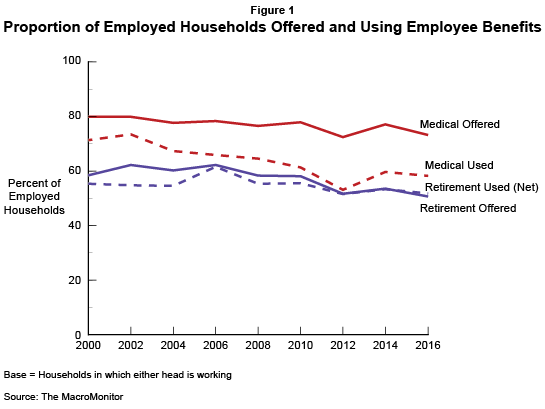

Health insurance and retirement are the two benefits that most employers offer their employees; they are the two benefits that most households use. The trend in Figure 1 indicates some cause for concern. For households in which either head is working, the proportion of employers offering health-care insurance to at least one employee has declined slightly from 80% in 2000 to 73% in 2016. The proportion of employed households that use employer-offered health insurance, however, has declined sharply from 71% in 2000 to 58% during the same period.

The comparable trend for retirement-savings plans is different. (For this analysis, we combined any occurrence of either head's current employer's offer of a 401k/403b/457 plan with any defined-benefit plan.) Although fewer employers (of households with at least one employed head) offer a retirement benefit than offer health insurance, almost all the affected households take advantage of at least one type of plan. Fifty-one percent of households with an employed head have an employer who offers a retirement benefit; 51% are taking advantage of that benefit. Since 2000, the proportion of employed households with employers offering a retirement benefit has declined from 58% to 51%, but the proportion of employees taking advantage of this benefit is little changed—from 55% in 2000 to 51% in 2016.

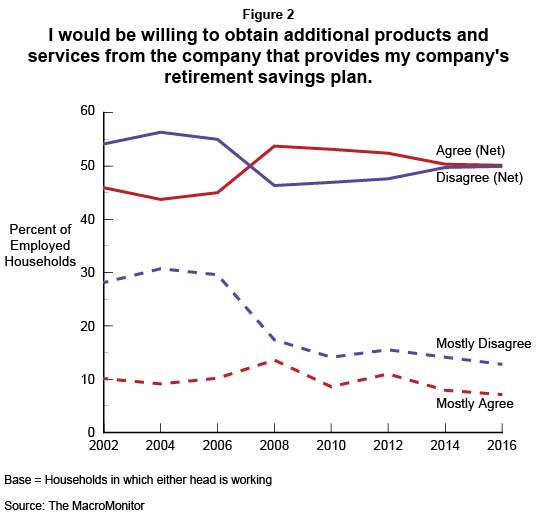

Although available to half of all employed households, a retirement benefit may provide a better "launching platform" than health insurance for offering additional products and services through work-site marketing because of the high proportion of penetration. Although nearly 75% of employed households' employers offer health insurance, only 58% of households take advantage of this benefit—compared with almost all who take advantage of a retirement benefit (51% offered; 51% use). Among employed households, receptivity to obtain additional products and services from their employer's retirement-savings-plan provider (Figure 2) displays an even split between households that agree and households that disagree. The trend of employed household heads who mostly agree has remained stable since 2000 at about 10%; employed heads who mostly disagree has declined from 28% to 13%.

In addition to tracking health-insurance and retirement-savings plans, the MacroMonitor tracks many types of employee benefits, offered and used, including Dental, Vision, Life Insurance, Disability Insurance, Long-Term Care, and Financial Advice. Sponsors may request trends and profiles of these populations at any time. For firms interested in work-site marketing, this month's Segment Summary explores employed households that say they are willing to obtain additional products and services from their employers' retirement-savings-plan provider.

To learn more, contact us. From their CFD client-landing page, MacroMonitor subscribers may:

- Access the February 2018 Segment Summary, Work-Site Marketing's Potential.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.