Trends Newsletter January 2022

If you would like more information about this topic, please contact us.

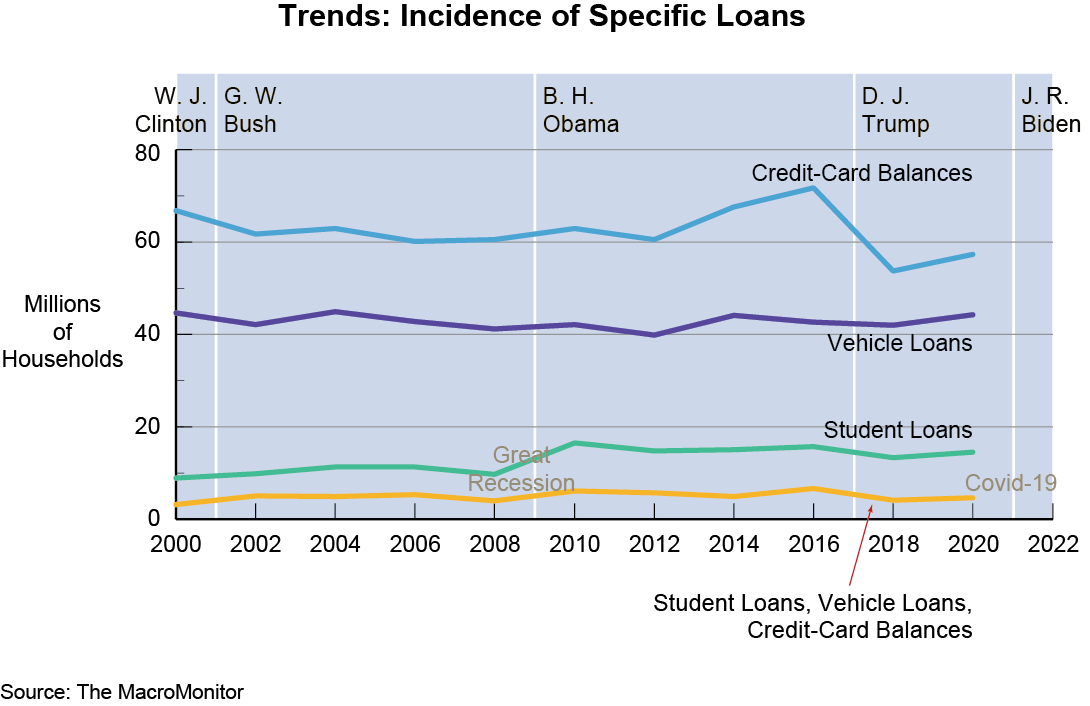

A Debt Trifecta

As we enter another year of Covid‑19, we review where US households (HHs) stand on debt: credit-card balances, vehicle loans, and student loans. When thinking about HH debt, it's important to consider fixed expenses—housing, food, utilities, energy, and health care—all of which are increasing in cost. Early in the pandemic, consumer spending was curtailed. With the aid of government-stimulus programs, some HHs have taken the opportunity to pay-down debt, but the window to do so is closing. Moratoriums on evictions, forbearance on mortgages and utilities, and loan-payment delays have, or are about to, end.

Although total US consumer debt has increased from $14T to $15T (2019 to 2020), credit-card debt has decreased from $868B to $787B (2019 to 2021). According to Barons, "Americans have cut their spending even faster than they've lost their jobs." Over an 11-week period in 2020, the 10.5% drop in credit-card balances was the steepest decline on record; 2018 was the last time credit-card debt (and unemployment) was so low. Presently, unemployment claims are low, but 11M jobs (many of them low wage) are on offer with few takers. The MacroMonitor reports the number of HHs with a credit-card balance declined from 72M to 54M (2016 to 2018), up slightly to 58M HHs in 2020.

In 2020, vehicle-loan debt increased to $1.3T: the average amount owed is $18K (2020–21 MacroMonitor). The number of HHs with a vehicle loan has increased from 42M to 45M (2018 to 2020): higher credit scores are needed more today than previously to qualify. Vehicle inventories are at historic lows; prices—even for used vehicles—are at historic highs (when you can find one to buy).

Student-loan payments resume this February 1 unless policymakers pass promised student-loan forgiveness legislation. (Late-breaking news: 22 December 2021, President Biden extends pause on student-loan repayments until 1 May 2022.) College-tuition costs are increasing even though enrollments are decreasing; one reason, a college degree may no longer be seen as a key to success for some men in Generation Z. While enrollments are down, the number of HHs with student loans is up; 15M in 2020, up from 14M in 2018.

Almost 5M US HHs have all three types of loans. Not surprisingly, about one-half (52%) are Millennial HH heads (30% are Younger Millennials). Overall, Millennials have lived during some challenging economic times: The dot-com bubble in the late 90s, the Great Recession 2007‑10, a postcrisis job market, and most recently, the pandemic shutdown. On the flip side, HHs fortunate enough to have investments (generally) have enjoyed a bull market since 2009 (notwithstanding a 33-day bear market at the beginning of 2020 and present volatility).

However, Millennials have never experienced rapid inflation. Home prices (+12.4% in 2021), rents, food, and the cost of most other essentials increase weekly. Pocketbook issues (inflation) are nudging out climate-change issues as the number one cause of concern. Prices of many consumer products have been on the rise because of the semiconductor (microchip) shortage and supply chain problems; neither problem has a short-term remedy. On 9 December 2021, during a year-in-review digital event, the editor-in-chief of The Economist (Zanny Minton Beddoes) stated she believes that, in contrast to what many central bankers continue to assert, inflation in the US is not a transitory problem because it's a global problem. What happens with China's economy affects the rest of the world. (The New York Times [10 December 2021] reports that consumer prices rose nearly 7% in November.)

A sizeable portion of households with debt have been making ends meet; some, in fact, have been doing rather well. Government stimulus programs have helped many stay comfortably solvent. The situation will change when the Fed raises interest rates in 2022. Consumer spending will contract for all but the wealthiest households; in fact, higher interest rates will help households with investments (most lawmakers have considerable investments). For minimally solvent households that have been solid credit risks up to now, higher interest rates may prove to be the straw that breaks the camel's back.

To learn more about vulnerable households and opportunities for your organization, contact us.

Additional deliverables are available to MacroMonitor subscribers:

- The January 2022 Stories: Credit-Card, Vehicle, and Student-Loan Debt

- The underlying data set for this month's Stories (by request).