Trends Newsletter April 2022

If you would like more information about this topic, please contact us.

What's Up with Men?

Actually, quite a lot. "As the college educated become healthier and wealthier, adults without a degree are literally dying from pain and despair"—deaths "from suicide, drug overdose, and alcoholism" continue to rise. For what used to be the middle class, "America has become a land of broken families and few prospects." For many blue-collar workers, capitalism isn't working. While job productivity has increased steadily since the 1970s, real wages have not.

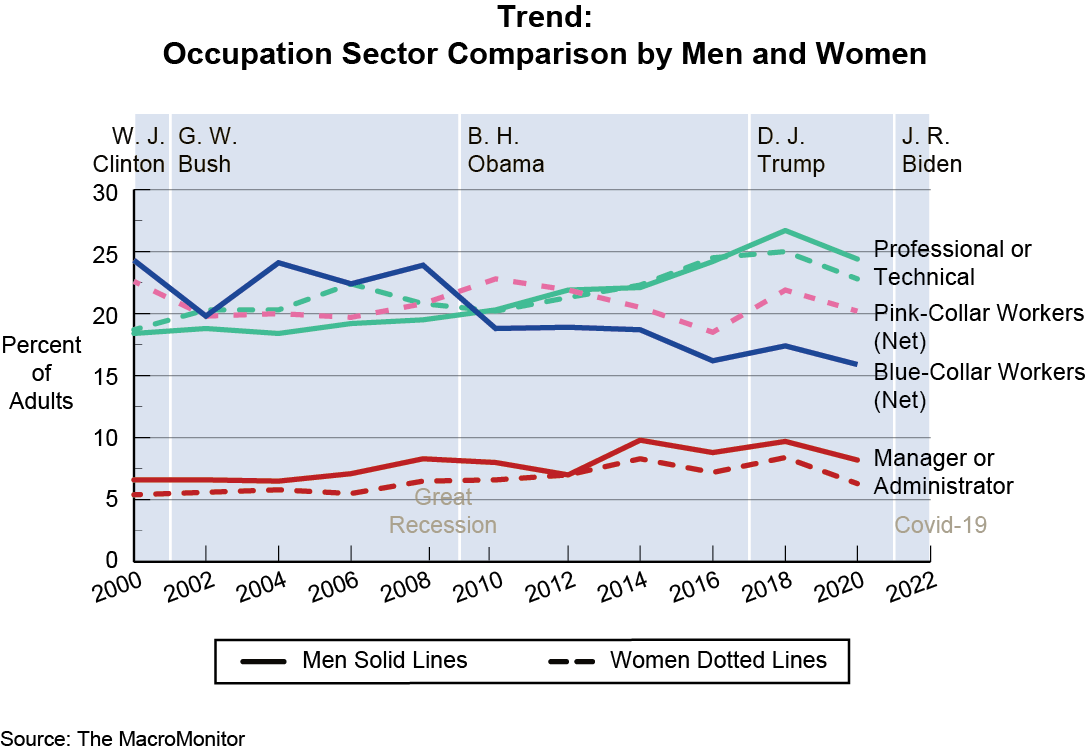

This month we look at changes in the workforce from the early-century's recession for non-college-educated workers, the resilience of pink-collar over blue-collar workers highlighted by the Great Recession as the country shifted from service industries (make it, deliver it, install it, maintain it) to "care" industries (hospitality, food, health care, and travel), and the impact of Covid‑19 when businesses closed and everyone who could, learned how to work from home. In 2020, about 100,000 more men than women professional or technical workers left the workforce; 600,000 more women than men managers and administrators quit (the sector generating the majority of attention because it wipes out 30 years of hard-won gains for women); and the year saw the exit of 200,000 more pink collar workers than blue collar workers (many of whom are the care givers upon which workers depend). Many men as well as women are burned out from being "on call" 24/7.

Arguably, the most important trend line in the chart above is for Blue-Collar Workers—the line mirrors the decline of the middle class. The increase of pink-collar (care) jobs does not offset the loss of blue-collar workers, even though both often require specific skills and a license. Most blue-collar manufacturing jobs have been exported, because companies can make more profit for shareholders by contracting with offshore workers than supporting the US economy by keeping domestic workers employed at a life-sustaining wage. Covid has exposed decades of infrastructure failures caused by insufficient funding of critical maintenance; the result is a loss of many middle-class jobs. For example, there is no lack of new truck drivers, but the trucking industry has a huge retention problem due to the disparity between the promise of independence and high pay, and the reality of no benefits and low pay. The lure to 18- to 20-year olds of good, long-haul truck driving jobs is hype.

From the end of WWII until the late 1970s, US workers' wages and the US economy grew in tandem. The period, known as the Great Compression (of wages), was based on the concept of a "virtuous circle of growth:" improving workers' skills increased their pay, and profits from higher company productivity were shared with the workers who made it possible. Consumerism increased. A labor-studies paper explains that, "employers viewed their employees as assets to be developed rather than costs to be controlled." The country experienced a period of continuous growth, and our strong middle class became the envy of the world. Until the late 1970s, workers' unions proved an effective method to counterbalance corporate exploitation of workers. Unions also provided workers with an important voice. After four decades of decline, there is now a renewed interest in unions. Liz Shuler, the first woman president of the AFL-CIO, is committed to passing a landmark worker-empowerment bill: the Protecting the Right to Organize (PRO) Act.

In 1970, economist Milton Friedman published his shareholder theory of business ethics, stating that "an entity's greatest responsibility lies in the satisfaction of the shareholders" and "does not have any social responsibility to the society around it whatsoever." All that mattered was profit returned to stockholders—all other stakeholders be damned! Two noted liberal economists discuss links between the resulting war on unions and the demise of the middle class: Paul Krugman discusses the importance of unions as one of the few effective methods to counterbalance big business; and Robert Reich discusses how the war on unions has resulted in greater inequality.

Other factors have certainly contributed to the changing size and composition of the job market. Unquestionably, mergers and acquisitions (M&A) have played a role. "The 1990s featured the most intense period of mergers and acquisitions in U.S. economic history." Since 1998, the largest M&As have been in the oil and gas, pharmaceutical, media, banking, and airlines industries; some of these industries employed high numbers of blue-collar workers. Also contributing to increased drop-out rates for boys was the 1970s K12 education system shift to collaborative learning and open classrooms—both situations favor (verbal) girls. Girls began to graduate high school, and enter (and graduate) college, at higher rates than boys. Many boys fell further and further behind in high school, never went to college, and have never been able to catch up.

Research shows that men tend to blame failure on others. Repeated failures to be an adequate breadwinner can bring a deep sense of shame. Men experiencing shame, acute stress, interpersonal difficulties, a history of bullying, financial instability, failed life aspirations, and who are unable to form intimate relationships with women are singled out in a new US Secret Service domestic terrorism report (March 2022). These men are a danger to society and to democracy because they fail to understand the consequences of their anger, demonstrated in the rising violence against women, minorities, and (perceived) liberal government politicians and policy makers.

Helping blue-collar men become contributing members of society isn't an insoluble problem. The 2021 $1.2T infrastructure bill will offer opportunities to blue-collar workers. For financial providers to benefit from workers' gains, it is important to be aware that relationships are transactional; be respectful and helpful, but not too interpersonal. Learn more about all types of men, starting with their behaviors, attitudes, and critical financial needs in today's evolving world. Those financial providers who do so will benefit from any increase in these men's financial resources.