Trends Newsletter November 2022

If you would like more information about this topic, please contact us.

Climate Costs Hit Home

Layers of disasters (compounding catastrophes) are costing homeowners and taxpayers a lot more money than a decade ago. The National Center for Environmental Information (NCEI) estimates that in 2021, the US spent $145bn on 20 extreme disasters. Although the Federal government pays 70% of disaster relief, the costs of related unemployment and medical benefits far exceed the amount of money spent on immediate disaster-relief payments. Residual costs for treatment of extreme heat exposure, poor air quality and polluted waterways, agriculture, animal, natural-resource and habitat losses are not included in the $145bn. Current government disaster-relief spending is not sustainable.

Families are often financially devastated because of weather-related events—tornadic and hurricane-level winds; heavy precipitation, flooding and mudslides; drought, wildfires and deforestation; snow bombs and Artic clippers. Scientists agree, natural disasters are made worse by climate change. At the same time the number and severity of climate events are increasing, the housing shortage encourages building in climate-vulnerable areas. To 'ease' the housing shortage, building approvals are often given by local politicians without vision and, until revised, projects are built using outdated building specifications. Banks are complicit by funding developers of climate-risky projects; mortgage companies collaborate by granting mortgages to applicants for properties in extreme-climate prone areas. For some insurers, mortgage lenders, banks, and investment companies, climate change makes some portion of their business unprofitable and therefore, unsustainable.

Florida (FL) experiences 40% of the country's hurricanes, but continues to experiences a huge population boom. Homeowners in the state "pay the highest average annual homeowners insurance premiums" ($4,231 versus $1,544 nationally). Although Floridians are four to five times more likely than the average US household (HH) to have additional flood insurance, only about 18% to 20% of FL HHs do so. Flood insurance, mandated for mortgaged homes in flood-prone zones, is rarely sufficient to cover replacement costs. Private FL insurers have collectively lost more than $1bn annually for the past two years. Insurers' are further impacted when states such as California find it necessary to ban insurance companies from dropping customers due to wildfires (September 2022). For many homeowners, annual policy-rate increases are simply not feasible.

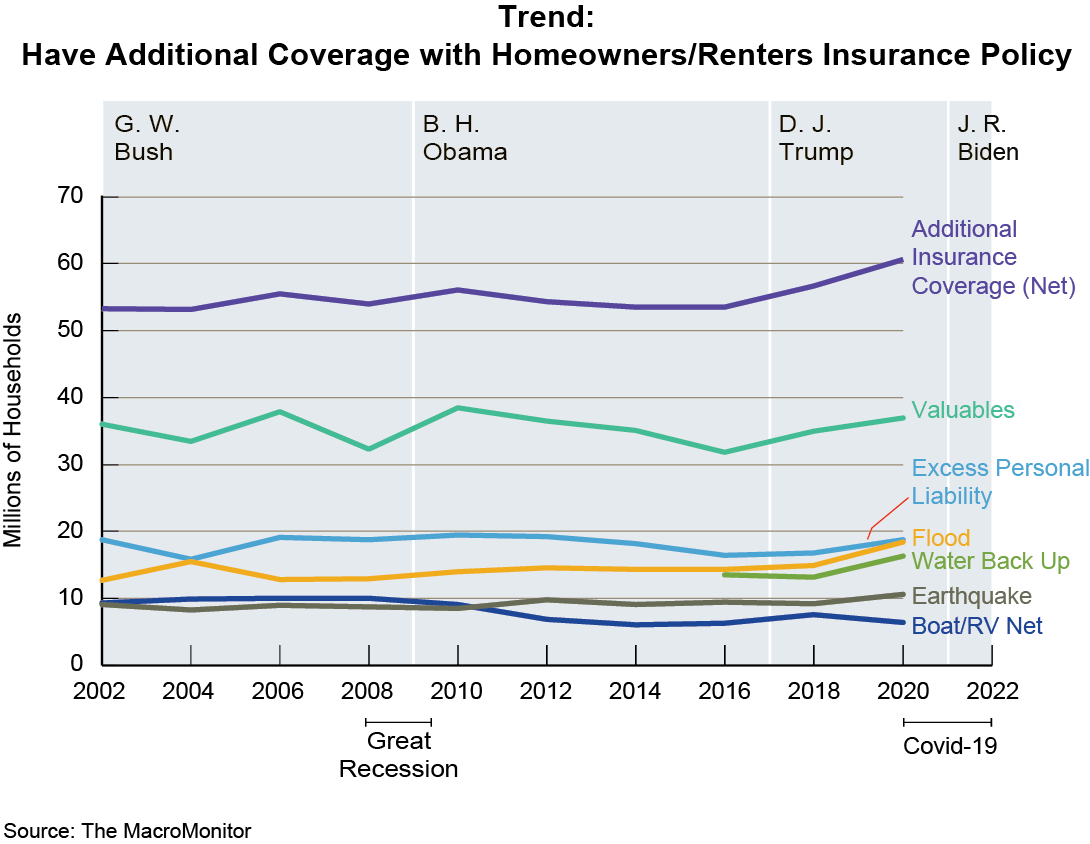

The incidence of HHs with additional property and casualty (P&C) insurance on their primary residence (57%) is primarily driven by geography (Census Regions). For example, 63% of HHs in the West North Central Region and 60% in the South Atlantic Region are the most likely of all HHs to have additional P&C insurance. One-quarter of HHs in the Pacific Region are more than twice as likely as all homeowners to have earthquake insurance; HHs in New England are more likely than average to have Excess Personal Liability insurance; HHs in the Mountain Region are twice as likely as all HHs to own additional insurance on Boat/RV/and Recreational Equipment. With the exception of the later, proportions of HHs with all other types of additional P&C insurance are increasing.

Many factors converge with geography to indicate whether additional P&C insurance is a sound investment; age is one example. Zoomers will be the first generation to bear the full brunt of environment degradation. Their generation will need to be instrumental in climate-mitigation efforts. Many young HHs are moving into new neighborhoods sometimes built in climate-prone areas where land is still available at affordable prices. Case in point: HH heads under age 30 are 30% more likely than all HHs to have flood insurance and 80% are more likely to have earthquake insurance. Ethnicity is another factor to consider: Black- and Hispanic-Americans are more likely to have flood insurance than all other HHs; (high proportion reside in the South Atlantic Region). Asian and Hispanic HHs are more likely than other insured HHs to have earthquake insurance (high proportions reside in the Pacific Region). The MacroMonitor enables financial-service providers to understand all populations by region, age, or ethnicity; singly or in combination.

For financial institutions, the increasing number of HHs devastated by disaster and the associated costs of climate impacts portend a worrisome future. Environmental considerations will not only determine internal migration, but will reshape the housing, insurance, and investment industries. The 2020s may be the decade of climate reckoning. Where do your opportunities lie?

We 'speak' consumer HHs. For example, we know about P&C insurance, and attitudes about the environment. We're happy to speak with you about your concerns. Contact us to set up a call, Zoom, or WebEx.