Trends Newsletter January 2023

If you would like more information about this topic, please contact us.

Mobile Payments On Schedule to Increase

In the beginning (before portable phones) ... taxi drivers and construction workers used two-way radios for mobile communications. By the 1970s, portable phones were carried in a small suitcase; mobile phones were installed in cars powered by the vehicle's battery; licenses were few, costs were high; many were used by top government employees and people with chauffeurs. 'Brick' phones were the next iteration of mobile, so named because the built-in battery was the size of a large brick although not so hefty. In 1989, Motorola introduced the flip phone that could be held easily in one hand. The beginning of the mobile era as we know it today emerged. With the advent of smartphones, keyboards, touch screens, internet browsers, cameras, apps and all the features we're now familiar with followed. Gen Z has never known anything other than smartphones. Phone history is interesting because phones have driven cultural changes in society.

When mobile phones became commercially available, after first upscale adopters (new technology is always expensive), it was 'working men' who adopted mobile—not by choice. Employers with workers in the field or on the road supplied phones to increase worker productivity and efficiency, trouble shoot, and enable the worker's wife to remind her husband to pick up bread on his way home. Mobile phones are one of the very few mass-market success stories driven by blue-collar workers (paid for by employers). Smartphone adoption rates increased when Google introduced mobile wallets (2011). One pocket-size gadget replaced a wallet, phone, watch, and personal computer for about half the price of a 1970's car phone with "more computing power than all of NASA back in 1969 when it sent two astronauts to the moon." Computing aside, most working men, especially blue-collar men, find a smartphone to be less bulky and safer to carry on the job than an old-fashioned wallet with paper money and cards.

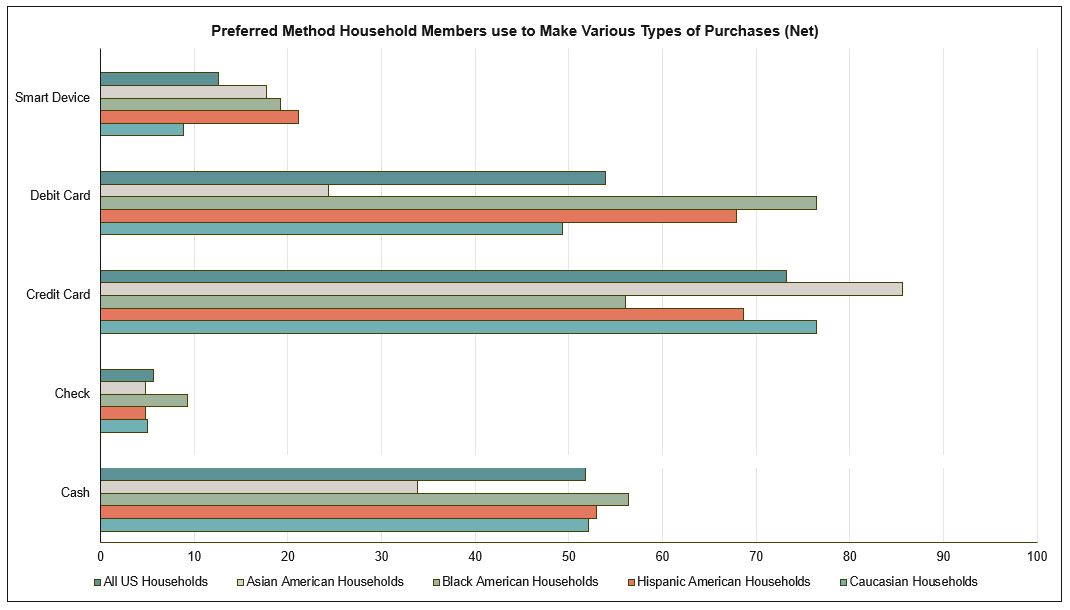

Cards continue to dominate the payment space; hardly anyone writes checks these days—so‑o‑o‑o analog. See October (Transaction Evolution) and December ('Tis the Season for [Credit Card] Spending) Newsletters for more about cards. One in five household heads under age 34 in 2021 however, preferred to pay for purchases using a smart device. It's not surprising that Zoomer (Generation Z) change agents are leading the shift to mobile. Intuitively, age and generations are obvious differentiators between segments with varying payment preferences.

Less intuitive, but more insightful, are payment preferences by ethnicity as shown above. Asian HHs for example, show a strong preference for credit cards. Black American HHs a preference for debit cards (to help control spending). Hispanic households are the most likely to prefer mobile platforms for several reasons including control and credit, but also because many are young and don't have a history with landlines. Caucasian heads prefer debit cards and cash in roughly equal proportions; they have the highest mean age and the lowest preference for paying by smart device.

Occupation can be extremely helpful when assessing the market potential along the adoption curve for a product or service. Asians are principally occupied in professional, technical, managerial, and administrative positions. Hispanic and Black heads tend to have occupations in the trades—machine operators, labors, service and craftworkers. As it was in the 1960s, today's blue-collar workers are relatively early adopters of mobile payments because of convenience. Asian headed HHs gravitate toward mobile platforms for different reasons entirely; they are among the most likely to use innovative products, services and platforms to accomplish all types of tasks. Overall, except for households with some discretionary income, Caucasian HHs lag in the adoption of mobile payments. Caucasian HHs still dominate the marketplace.

Technology adoption and mobile payments escalated during Covid, but Asian and Hispanic headed HHs (among the youngest in the country) are driving mobile-payment adoption not because it's convenient, but because doing so simplifies their lives. Stay tuned to learn how quickly mobile is moving to mainstream.

In the end... ethnicity provides insights into nuanced communications; occupation can uncover product and service opportunities; age can help size the market. Used in tandem, these demographics reveal a more complete picture upon which to develop your strategy. The MacroMonitor provides combinations of data to identify opportunities faster.

We 'speak' consumer HHs. Contact us to book a meeting on Zoom, WebEx, or Teams.