The Growth of the Consumer-Genetics Market Featured Signal of Change: SoC956 July 2017

In 2014, DNA-sequencing-market leader Illumina (San Diego, California) announced that it had created a system (the HiSeq X Ten) capable of sequencing a human genome for less than $1,000. Although the company began selling the room-filling system for the pricey sum of $10 million, enabling the sequencing of a whole genome for less than $1,000 was still a milestone achievement for the industry. The cost of DNA sequencing has continued to decrease, making the process more accessible to a greater number of organizations—particularly organizations in fields such as research and medicine. Other companies have released devices that increase the accessibility of DNA sequencing to new industries. For example, Oxford Nanopore Technologies (Oxford, England) released its much-anticipated MinION sequencing device in 2015. The USB- (Universal Serial Bus–) powered handheld device sequences DNA and RNA in real time and costs only $1,000. The MinION's portable size and low cost could enable the use of sequencing in novel application areas such as food safety. Indeed, US astronaut Kate Rubins used the MinION aboard the International Space Station to sequence DNA in space. The falling costs of sequencing have helped grow the burgeoning consumer-genetics market, enabling sequencing companies to sell affordable testing services directly to consumers. These services are branching out to find applications in a variety of industries.

The mismatch of commercialization and regulatory developments has the potential to lead to instances in which consumers make judgment errors about their health or lifestyle because of the results of DTC genetic tests.

Direct-to-consumer (DTC) genetic testing has existed for several years, enabling consumers to use simple DNA tests to learn about their heritage and, controversially, their risk of experiencing certain medical conditions; however, consumer genetics has faced and continues to face hurdles. Regulators have voiced concerns about the possibility that consumers will use the results of these tests to make health choices without seeking advice from medical experts. But the DTC-genetic-testing business is very profitable. For example, Myriad Genetics (Salt Lake City, Utah) generated more than $632 million in revenue with its hereditary-cancer tests in 2016. The market potential of DTC health-related genetic testing could be similar in size to if not larger than that of doctor-ordered tests. But the US Food and Drug Administration (FDA; Silver Spring, Maryland) was initially wary of DTC testing.

In 2013, the FDA prohibited 23andMe (Mountain View, California) from marketing its DTC health-related genome tests, leading the company to look for more amenable regulators in foreign markets. In 2014, the UK Medicines and Healthcare Products Regulatory Agency (London, England) authorized 23andMe to market its tests but advised consumers to use such testing services with caution. In 2015, the FDA authorized 23andMe to market a genetic test that identifies whether individuals are carriers of a specific autosomal recessive disease. But the major breakthrough for consumer genetics in the United States came in April 2017 when the FDA authorized 23andMe to market DTC tests for assessing a person's genetic predisposition to a number of diseases, including Alzheimer's, Parkinson's, and celiac diseases. This authorization represents the first instance of the FDA's permitting consumers to bypass their physicians and order disease-risk genetic tests directly from companies. Some people in the health-care industry still have concerns about DTC genetic testing. They worry that the proliferation of DTC tests will lead to patients' demanding that their physicians order expensive further testing and treatments in efforts to ensure that the diseases DTC tests indicate they are predisposed to do not materialize.

Confidence in the accuracy of the analyses that DTC tests deliver is increasing, which is one of the reasons the FDA has chosen to approve several of the tests. Improvements in bioinformatics and big data in the life sciences are expanding knowledge about genetics. As this knowledge expands, it enables the use of DNA sequencing in new areas. DNAFit (London, England)—one of a growing number of DTC-sequencing companies that analyze consumers' DNA to provide personalized advice about diet and fitness—is working with fitness-retreat provider 38 Degrees North (Hitchin, England). Fitness-retreat attendees provide a saliva sample that DNAFit analyzes to determine the attendees' VO2 max (how much oxygen the body can take in and send to muscles), to identify attendees' food sensitivities and dietary requirements, and to ascertain the ratio of cardio exercise to strength training that will be most effective for attendees. Using these data, 38 Degrees North creates personalized diet and exercise programs for fitness-retreat attendees.

Consumer genetics is a burgeoning industry, and improvements to and declining costs of technology are driving its rapid expansion. This expansion appears to be occurring at a rate faster than the rate of increase in public understanding of genetics. Although regulatory authorities have approached consumer genetics with caution, the mismatch of commercialization and regulatory developments has the potential to lead to instances in which consumers make judgment errors about their health or lifestyle because of the results of DTC genetic tests.

However, the growing consumer-genetics industry is facing a much more widespread problem: risks to consumer data and privacy. According to a 2016 report from IBM (Armonk, New York), cybercriminals targeted the health-care sector more than any other sector in 2015, resulting in the compromised security of more than 100 million health-care records. Medical records provide criminals with a rich source of personal data, including medical-history details and contact and financial information. Genetic testing—particularly whole-genome sequencing—can reveal a great deal of personal data, and many people have strong concerns about the ability to protect such data from thieves who could use it to impersonate or blackmail them. IBM's report highlights that safeguarding the data that medical records contain is challenging even for large health-care companies. Because of the consumer-genetics industry, consumer-genetics companies and consumers now possess these data, creating additional security risks. Individuals, companies, and regulators alike will become increasingly concerned about the protection of genetic information as the consumer-genetics market expands.

The Development of this Signal of Change

Data Points

- Myriad Genetics generated more than $632 million in revenue with its hereditary-cancer tests in 2016.

- In April 2017, the FDA authorized 23andMe to market direct-to-consumer tests for assessing a person's genetic predisposition to a number of diseases, including Alzheimer's, Parkinson's, and celiac diseases.

- DNAFit—one of a growing number of direct-to-consumer-sequencing companies that analyze consumers' DNA to provide personalized advice about diet and fitness—is working with fitness-retreat provider 38 Degrees North.

Implications

The Growth of the Consumer-Genetics Market

The falling costs of sequencing have helped grow the burgeoning consumer-genetics market.

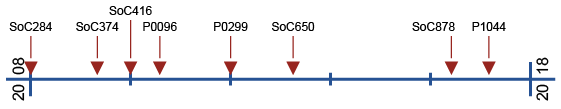

Previous Alerts

- SoC284 — Consumer Personomics (January 2008)

Prices for genetic-testing services are reaching a point that makes genetic tests increasingly accessible to an increasing number of people. - SoC374 — Gene Selecting (May 2009)

Recent developments in genetic research indicate that gene-selection technologies may eventually see application in influencing people's intelligence, competitive drive, and interpersonal relationships. - SoC416 — Corporate Genetic Liability (January 2010)

Tinkering with genetics, whether by individuals or by skilled geneticists, could have serious consequences in the future from not only a legal perspective, but also social, economic, political, and cultural perspectives. - P0096 — Genomics-Driven Personalization and Hype (August 2010)

Complete genome sequencing offers new health-care opportunities to personalize medication, to customize services, and to cater individualized approaches to consumers. - P0299 — Mining Data and DNA (January 2012)

Algorithmic mining of genetic databases holds new promise for disease and drug discovery. - SoC650 — Genetic Sequencing's Double-Edged Sword (April 2013)

Ease and low cost of genetic sequencing, ready access to genetic sequences, and a cheap and easy way to synthesize viruses may lead to not only medical breakthroughs but also biosecurity concerns. - SoC878 — Genetic Games without Frontiers (June 2016)

New technologies and approaches are opening the door to increasingly invasive genetic interventions. - P1044 — The Great CRISPR Race (March 2017)

Nations may find themselves in a race to advance CRISPR-Cas9 research and development.