Paying with Your Phone August 2017

What is easiest? Finding your wallet, pulling out cash, and waiting for the cashier to give you change? Finding your wallet, pulling out a credit card, swiping it in the in-store credit-card reader, and (sometimes) signing on a tiny display that mangles your handwriting? Or finding your cell phone and hovering it over the in-store payment-card reader? Mobile-pay enthusiasts are sure that the last is the best, fastest, easiest way to pay.

But the jury is still out in the United States, where use continues to be relatively rare. The three main commercial mobile-payment apps in the United States today are Android Pay (which is Google's reincarnation of its previous Google Wallet), Apple Pay, and Samsung Pay. All three of these apps enable shoppers to pay for items in brick-and-mortar stores by bringing their smartphone (or other mobile device—for instance, a smartwatch—in contact or proximity with in-store card readers.

Because many Americans keep their phones handy, one might think this new form of payment would really take off—but it hasn't. Why not? Not all retailers' in-store card readers work with these mobile payment systems. Shoppers' inability to use the mobile pay systems everywhere—as they can with cash and credit or debit cards—seems to be a barrier for them. Apple, Google, and Samsung are working hard to address this barrier by signing up more and more retail stores and banks to accept their services. Banks hold the shoppers' money and issue the credit or debit cards that are key to the way mobile payment systems work.

Apple Pay works with the largest number of retailers. Apple put tremendous effort into establishing its retailer and bank ecosystem before it launched in 2014, and Apple has continued to add stores who accept Apple Pay, making payment by phone easier and easier for iPhone users. Both Android Pay and Samsung Pay launched with many fewer retailers onboard. But in an effort to overcome this consumer-adoption barrier, Samsung Pay integrated MST (magnetic-secure-transmission) technology in its phones along with the NFC (near-field-communications) technology that ApplePay and Android Pay use. The MST technology in Samsung Galaxy phones sends out a magnetic signal to the retailer's in-store card reader that the reader uses in the same way it reads the magnetic strip on a traditional credit or debit card. Consequently, consumers with any number of Galaxy phones and the Samsung Pay app can theoretically use their phones to pay nearly every retailer, because retailers don't have to invest in an NFC technology upgrade to their in-store payment readers.

Apple Pay and Android Pay, by contrast, did not integrate MST into their phones. They use only NFC technology to communicate payment information between the payment app on the shopper's phone and the in-store payment reader. Retail stores have had to upgrade their traditional credit-card readers with NFC in order to accept mobile payments from Apple and Android Pay. Samsung seems to have had a smart idea in using a technology that does not require retailers to upgrade, but Samsung Pay is not winning the mobile payment race, as far as VALS™/GfK MRI's US national survey data indicate. Fall data from 2016 show that Samsung Pay had only 0.18% of US adults' saying they used it within the last 30 days, in comparison with 0.67% reporting use of Android Pay and 2.4% reporting use of Apple Pay in the last 30 days.

The smaller Samsung Pay numbers may be due to another Samsung decision. Only its high-end phones such as the Galaxy S6, S6 Edge, S6 Edge Plus, and Galaxy Note 5 have MST and NFC. This limitation means owners of midrange and low-cost phones can't use Samsung Pay. Google, by contrast, took a contrasting tack by offering its Android Pay technology to a wide audience of third-party smartphone manufacturers that are integrating Android into all kinds of phones that sell at various price points.

Apple Pay's lead in number of users is likely due to two factors: being out of the gate before its competitors (2014 versus 2015 for Android Pay and Samsung Pay) and its ahead-of-launch development of a large ecosystem of retailers and banks—including American Express, MasterCard, and Visa, which were ready to go on Day 1.

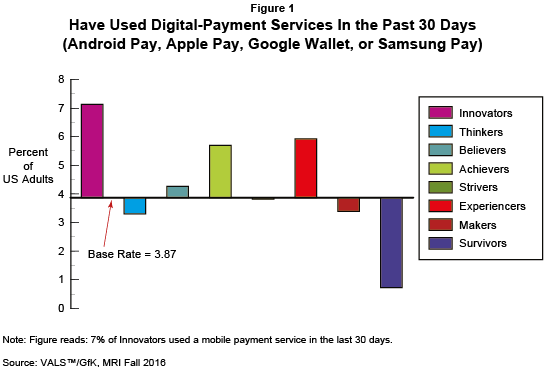

Although many Americans have become comfortable with buying goods online with doorstep delivery, only about 4% of US adults said they had used a mobile pay system such as Apple Pay, Android Pay, or Samsung Pay in the last 30 days to make a purchase. The chart below shows the VALS consumer types of those users.

Innovators and Experiencers are the two most likely groups to have used mobile pay, with Achievers ranking third. One might wonder if these groups are the top three to use mobile pay because they are the most likely to own smartphones and smartwatches—devices necessary to make mobile pay work. Interestingly, though, smartphone ownership is high—over 80%—in all but one of the VALS US consumer groups (95% of Experiencers, 95% of Achievers, 92% of Innovators, 86% of Strivers, 84% of Thinkers, 84% of Believers, and 81% of Makers own smart phones), so ownership alone doesn't explain the top three rankings. (For Survivors, however, not owning a smartphone likely is a barrier: 60% of Survivors do not own a smartphone.)

What seems to separate early adopters of mobile pay from nonusers is differences in their consumer mind-sets. Innovators and Experiencers are known for their techno-optimism and willingness to experiment with services that are new and different. They are drawn to new ways of proceeding, especially if the new ways streamline a mundane process and save time. Innovators and Experiencers are often early adopters of first-generation services, open to taking a gamble on whether all the glitches are out of the service.

It may be significant that Achievers are also using mobile pay. Achievers' adoption of new services tends to indicate some level of mainstream acceptance. Although Achievers look for ways to save time and increase efficiency in their lives, as Innovators and Experiencers do, they don't like looking foolish or awkward in public, so they tend to hold back on first-generation versions, waiting for the improvements that come with time through market use. Some mobile pay users report that it is embarrassing to stand in the checkout line ready to pay with their phone only to have the system malfunction. Quite unlike Innovators and Experiencers, who enjoy being first, Achievers prefer to wait until people whom they know recommend it.

A mobile pay benefit—if it is easy to use—that is likely to appeal to all three of these consumer groups is the ability to automatically organize, track, and spend coupons, gift cards, loyalty points, and other kinds of retail promotions in digitized form via apps that interact with the mobile pay systems. Digitized receipts might also make product returns easier. Improved payment security, at least over that of traditional plastic magnetic-strip credit and debit cards, is another potential mobile pay benefit, although new plastic EMV (for EuroPay, MasterCard, and Visa) credit cards or "chip cards" may weaken mobile pay's perceived security advantage.

Mobile pay system providers, retailers, and banks that pay attention to the consumer mind-sets of these first users and those who follow have the potential to be more effective in promoting system benefits in ways that are particularly motivating to these and prospective users. Mobile pay systems in the United States are in their early days. That they are attracting Innovators, Experiencers, and Achievers shoppers is a positive signal, even though overall numbers are still small.