Understanding Chinese Consumers with VALS™ November 2014

Want more free featured content?

Subscribe to Insights in Brief

Overview

VALS™ provides in-depth profiling of consumers from a personality perspective, focusing on deeper motivations that drive marketplace behavior. In a rapidly changing country such as China, with its growing middle class and frequent migrations, a focus on consumer motivations provides a much-needed, stable lens on consumers. China VALS allows companies to develop comprehensive marketing campaigns in a host of product and service categories, without having to reinvent their view about consumer dynamics after every planning cycle.

China VALS Background

According to economic projections, China will be the single largest economy in the world by 2020, increasing the importance of a thorough understanding of the Chinese-consumer landscape. The country itself is in flux, caught between traditional and modern ideals, and subject to an influx of Western commodities and luxuries, many of which see adaptation to accommodate a range of incomes, geographic regions, and preferences.

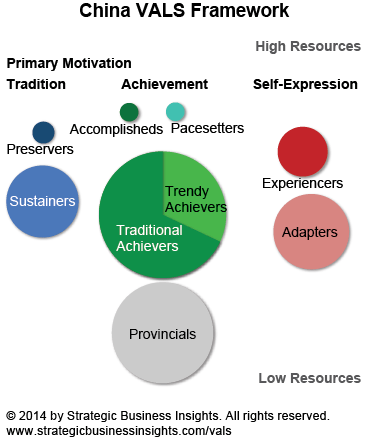

China VALS provides an understanding of consumers by going beyond demographic characterizations to include three primary motivations consumers live by. These motivations capture the dynamism in the Chinese marketplace:

- Principle. People motivated by principle wish to live according to the ideals of a traditional context that has stood the test of time. These consumers make choices on the basis of principles, rather than status, and are strongly motivated by traditional ideals of what is right and what is wrong. They direct energy toward preserving and conserving.

- Achievement. Achievement-motivated consumers, by contrast, pursue personal gain or advantage. They make choices to gain power, position, and prestige, and they use cultural values to further personal ambitions rather than intrinsically supporting the values. They direct energy toward setting goals.

- Self-expression. Finally, people motivated by self-expression do not wish to be constrained by principles or achievement. They often loosen or change social norms and make choices on the basis of novelty, excitement, and self-discovery.

Each of the three basic consumer motivations sees representation by two to four consumer groups. Even though several groups share a primary motivation, the groups show important differences in resources such as income, education, leadership, self-confidence and innovation, and associated lifestyles. China VALS contains a total of nine groups, projects to 516 million adults (excluding the rural poor and floating migrants), and covers eight major geographic regions.

Examples of China VALS Application

Clients use China VALS to identify the right consumer target for strategic-marketing initiatives and then use the segment profiles to guide decision making about product design, portfolio management, messaging, and so forth.

For diagnostic purposes, clients use VALS to see how ideas, products, or trends diffuse throughout the society—specifically to see where trends originate or stall and why.

China, with its upwardly mobile middle class, is seeing increasing availability and use of technological tools such as smartphones. Marketers interested in leveraging mobile marketing among the rising middle class could easily be convinced that these consumers all hold similar attitudes toward smartphones. China VALS allows for a more targeted approach to understanding the potential for mobile marketing among upwardly mobile consumers. Specifically, China VALS distinguishes between two types of Achievers (two instances of the Achievement motivation): Traditional Achievers and Trendy Achievers. Traditional Achievers (a 25% group) and Trendy Achievers (a 10% group) share the same mind-set of aspiration and keeping up with upwardly mobile China. However, Trendy Achievers are the most aspirational people of all in China, whereas Traditional Achievers often feel unsure about how to pursue success. About half the consumers covered by China VALS personally own a smartphone, according to SBI VALS data. Trendy Achievers are 26% more likely than average to own one, whereas Traditional Achievers are 20% less likely than average to own one. Trendy Achievers define success in part through ownership of high-technology goods and are a much better target for mobile advertising campaigns than Traditional Achievers are. Similarly, Trendy Achievers are 34% more likely than average to use a mobile phone for texting, whereas Traditional Achievers are 25% less likely than average to do so, affecting the effectiveness of text coupons. Distinguishing between types of upwardly mobile Chinese consumers allows companies to execute their marketing campaigns with more precision and, ultimately, better return on investment.

In an age of stable foreign-direct-investment opportunities in China, questions emerge for multinational corporations about how best to manage their brands locally, particularly given the abundance and acceptability of counterfeit brands in China. To complicate matters further, the Chinese government often takes a heavy hand in regulating advertising campaigns it classifies as offensive to traditional Chinese culture. China VALS Experiencers (high resource and self-expression motivated), a 10% group, are among the only consumers who do not actively experience the conflict between traditional and Western (modern) values and instead want to experience them all. For example, they may be equally likely to display signs of Chairman Mao and human-rights-activist Ai WeiWei on their clothing. Similarly, Experiencers are at market norm for indicating that they prefer to buy Chinese brands and that fake brands are as good as the real brands. Brand loyalty among the strategically important Experiencers segment appears elusive. However, Experiencers are excellent targets for "fusion marketing," which combines traditional and modern arts and culture in areas of food and clothing, for example.

By contrast, Adapters—the lower-resource counterpart to Experiencers—are 40% more likely than average to agree that they pay attention to brands when they buy and generally prefer Western to Chinese brands, thus expressing emulation and following of trends. The distinction between Experiencers and Adapters, both young and culturally open consumers, allows for more effective strategic-planning and brand-building activities for Western, regional, and domestic brands.

In a final example, China VALS can see effective use in strategic product-category expansion. Few Chinese consumers drink imported or domestic wine. Of consumers whom China VALS covers, 67% indicate they never drink imported wines, and a full 90% indicate they either never drink or drink less often than once per month. How could the imported-wine market see stimulation? Pacesetters—a high-resource, achievement-motivated group—want to be recognized by peers and to be seen as having a role or social position. Some Pacesetters may even desire fame. Pacesetters are 2.5 times more likely than average to drink imported wines once per month—a behavior about 4% of all Chinese consumers engage in. Pacesetters are strategic influencers for Trendy Achievers, who are already 30% more likely than average to consume imported wine once a month. A concerted effort to stimulate wine consumption among Pacesetters could, therefore, trickle down to Trendy Achievers, a more mainstream group in China, who might ultimately influence the much larger Traditional Achievers group. Foreign beverage distributors could recruit Pacesetters to serve as public role models for imported wines and stimulate consumption through incentives and reward programs.

To learn more about China VALS, contact the VALS team.