FinTech and Innovation Diffusion March 2018

Want more free featured content?

Subscribe to Insights in Brief

Many people are familiar with Everett Rogers's diffusion-of-innovation (DOI) theory and adoption-curve model that explains how, given time, "an idea or product gains momentum and diffuses through a specific population or social system." Rogers first published his theory in 1962 while a professor at Stanford University. He categorizes consumers into five groups: innovators, early adopters, the early majority, the late majority, and laggards. The social-science theory is still quite relevant as a method for companies to think about managing the life cycle of their products and services.

In 1991, Geoffrey Moore, an organizational theorist and former colleague of Regis McKenna (the marketing guru of Silicon Valley), published his first book, Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customers. The popular book for business and marketing executives explains the importance of understanding DOI in an age of disruption and offers a road map for companies to succeed; Moore's book is based on McKenna's consulting work to launch some of the high-tech industry's most notable brands: Intel, Apple, and others. Moore, currently a partner with Wildcat Venture Partners, works with start-up companies as well as established companies such as Microsoft and Salesforce. Because the pace of transformation caused by disruption continues to increase, the topic may be inexhaustible.

Beyond formalizing the DOI model and identifying consumer-adoption segments (Rogers) and extending DOI to business (McKenna and Moore), none of the men offer a practical method to identify various adoption segments in a given population or a solution to understand each segment to a degree that enables a company to anticipate and manage the consumer adoption process. In 1989, Silicon Valley–based SRI International—Strategic Business Insights' (SBI's) parent—had a consumer-segmentation model that could identify groups within the US population, but the system wasn't optimized to identify consumers as members of groups in Rogers's adoption model. However, in 1993, US VALS had an update (VALS2) to do so by incorporating the concept of innovation. Further, in 2015, SBI refreshed VALS to reflect the changing consumer environment caused by increased marketplace transformation. VALS 3.0, currently in use, enables users not only to identify Rogers's consumer groups but also to understand the motivations that are most likely to drive adoption.

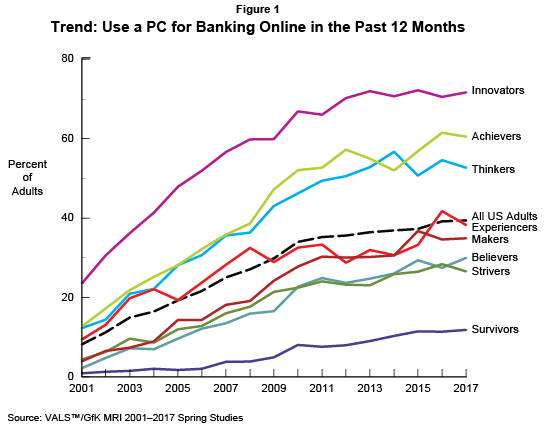

Adoption of business-to-consumer FinTech—"a portmanteau of financial technology that describes an emerging financial services sector," according to investopedia.com—begins with VALS Innovators (Rogers's innovators); VALS Survivors are always laggards. VALS groups that best represent early adopters, the early majority, and the late majority sometimes change depending on the product, service, or channel. For example, in the adoption of online banking between 2001 and 2017 (Figure 1), Innovators are the first to adopt; Achievers and Thinkers are the early majority; Experiencers, Makers, Believers, and Strivers are the late majority; Survivors are laggards. Between 2001 and 2017, the proportion of Innovators using online banking has increased from 24% to 72%; the proportion of Survivors doing so has increased from less than 1% to only 12%.

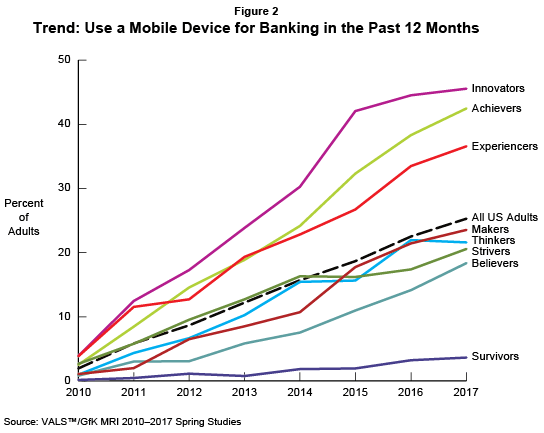

In 2010, the VALS national data partner, GfK Mediamark Research (GfK MRI), began to measure the use of a mobile device for banking when only 2% of US adults age 18 and older were doing so (Figure 2). FinTech enabled smartphones as a new channel, not as a new use. Between 2010 and 2017, the proportion of Innovators has increased from 4% to 46%. Survivors are again laggards: Survivors' use has increased to only 4%. The early adopters for the mobile-device channel, however, are Achievers and Experiencers. As of 2017, no early majority exists. Each group currently in the late majority—Makers, Thinkers, Strivers and Believers—has individual reasons for not adopting smartphones as a platform (channel) for banking. Reasons might include a low need for banking services or concerns about ID theft. A VALS analysis using MacroMonitor data from SBI's Consumer Financial Decisions can shed light on the reasons each group is not using its smartphone for banking and suggest steps an institution could employ to encourage adoption.

In 2016, Valarie Rind of GOBankingRates (a personal-finance resource owned by ConsumerTrack) forecasts that in ten years, banks will no longer offer:

- Branches and tellers

- Passwords and pins

- Checks and paper statements

- Cash

- ATMs and debit cards

- Traditional loans.

FinTech will fuel obsolescence. A number of banks have been in the process of closing physical branches, resulting in a need for fewer tellers; others are redesigning branches into places where customers can find instruction, information, and advice. Banks rarely return checks that clear the bank to the person who wrote them, and increasingly, customers must pay for paper statements. Tests are under way to replace passwords and pins with biometric ID. Traditional loans are vulnerable to peer-to-peer lending and borrowing. Even financial advisors may be replaced or supplanted by robo-advisors. For some people, credit cards and digital-payment services have replaced the need for cash. According to a 2016 Gallup poll, 62% of "Americans think the U.S. will be a cashless society within their lifetime." The most recent survey data available show that 26% of US adults have used any digital-payment service in the past 30 days—44% of Innovators; 8% of Survivors.

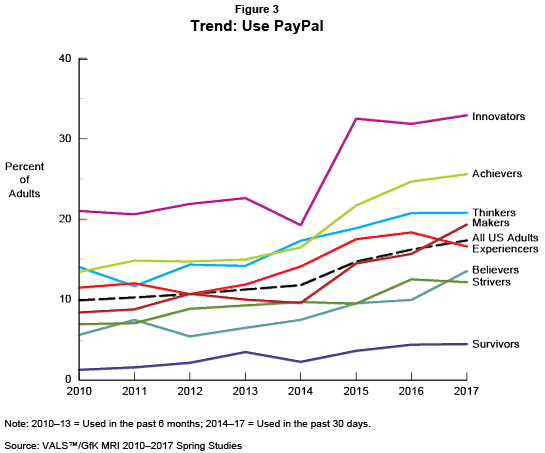

PayPal is a good illustration of the adoption of digital-payment services. Founded 1998, PayPal was the first digital-payment service of note. (Venmo, a mobile-payment service owned by PayPal, is not in the data in Figure 3.) In this example, Innovators are both innovators and early adopters. The decrease in Innovators' PayPal use is the result of a measurement change in 2014 from used in the past six months to used in the past 30 days. Achievers are the early majority. Thinkers, Makers, and Experiencers are the late majority.

FinTech presents a challenge and an opportunity for every business. Financial institutions face the most immediate challenge. Identifying the best technology and building (or buying) the platform for its delivery is only half the problem. A successful introduction and diffusion among consumer segments is the other half of the problem. FinTech adoption may be more of an evolution than a near-term transformation.

To learn more about how to use VALS for DOI from the not-yet-invented through to brand renewal, contact us.

Learn More about FinTech from Other SBI Programs

Explorer

Scan™

- Blockchain Technology's Proliferating Uses

- Digital Transformation of the Financial-Services Industry