MacroMonitor Market Trends Newsletter September 2016

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Impact of the Department of Labor's Fiduciary Ruling

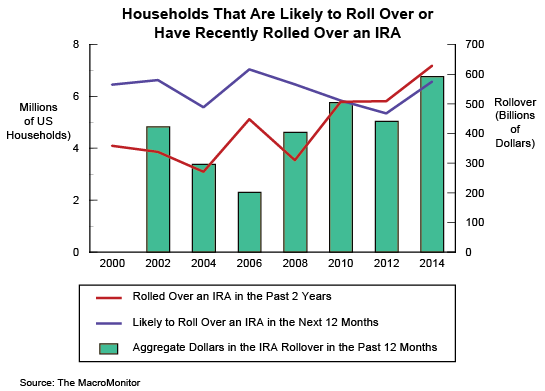

The shift from a suitability standard to a fiduciary standard for advisers active in the rollover of funds from a defined-contribution (DC) plan to an Individual Retirement Account (IRA) could be a narrow ruling involving a fairly rare event that occurs to an individual a couple of times only during the individual's career. Despite the rarity of the event, supporting research argues that applying the fiduciary-standard rules would save IRA owners over $40 billion in ten years. Even narrowly applied, the impact could affect about 7 million households and nearly $600 billion that rolls over into IRAs annually—the numbers are rising.

One may interpret the Department of Labor (DOL) ruling more broadly to affect any advice from, or management of any type of retirement account by, DC plan sponsors, financial planners, brokers, agents, financial representatives, and possibly even accountants and lawyers. Because many of the provided services already involve a fiduciary standard, the impact on these professions will be minimal. However, even for those professions for which a fiduciary standard is already in place, the nature of a household's retirement affects a spouse, children, and other stakeholders (such as siblings) and the sum total of the household's assets and debts—its balance sheet. Because the purpose of advice is to create and maintain a secure income (such as cash flow) during retirement, a complete understanding of the household's requirements and resources is necessary to apply a fiduciary standard effectively in both the accumulation and disbursement phases.

Not only are recent-rollover households more likely than all households to own all types of retirement accounts—IRAs (Roths, Simples, Traditional), 401k's, 403b's, 457's, and individual annuities—but at least one household head is also more likely than all household heads to have a defined-benefit pension plan. Providing good retirement advice requires knowledge about all retirement resources, retail investments, debts, and all forms of protection held; most households have a variety of them all.

Other demographic and financial characteristics of recent-rollover households make the task of providing good advice both complicated and difficult. Most of these households are in the preretired Life Stage, but the amount of owed debt is greater than that owed by all other households. The good news is that rollover households frequently secure advice before making major investment decisions. They are more likely than all households to use most types of financial institutions and intermediaries, and they tend to trust these firms and professionals. Many already have a written financial plan and wills in place.

Uncertainties about the future are overwhelming. Empowering households to be confident in their decisions through the retirement process not only fulfills the fiduciary standard but also can generate additional fees and commissions to providers. At the same time, doing so enables financial providers to do what is right.

To market effectively to the needs of recent-rollover households as well as to households likely to roll over an IRA next year, financial-services companies must understand the complex needs of these populations and how their financial attitudes differ from those of other investors and from those of each other.

For more information about this important topic, contact us.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Access the September 2016 Segment Summary, IRA-Rollover Households.

- View the September 2016 Quick Stats, Trend: Households with an IRA Rollover.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.