Scan Monthly No. 001March 2003 |

|

<< Other Issues of Scan Monthly |

Signals of Change

Trivial Pursuits

SoC001

"Trivial" applications such as downloadable cell-phone ring tones and viewer voting via mobile-phone short message service on reality-TV programs are generating millions of dollars of revenue. The willingness of consumers to pay a micropremium for a miniexperience can add up quickly to produce new income sources. The ability of phone companies to administer and bill small, unique payments through their existing billing structure is a major enabler for this type of service. As the capacity for micropayments increasingly turns up on the Internet and on wireless services, similar opportunities will emerge for other products and services. Some companies looking for the next big thing may want to go small.

Little Progress on Fair Use

SoC002

Recent developments in the digital copyright arena portend continued uncertainty and controversy. A January 2003 proposal by a landmark consortium of trade groups and a recent U.S. Supreme Court decision do little to resolve important fair-use issues. The trade groups, from both the content and com-puter industries, will try to navigate around the controversial Digital Millennium Copyright Act with solutions of their own to the ongoing problems of copyright-violating file-sharing schemes. Solutions that enroll consumers in profitable distribution networks, rather than turn them into litigants, remain elusive. And fair use will continue to be a major sticking point.

Data Federation

SoC003

The complex data-integration needs of the biotech industry are leading researchers and companies to develop federated databases—the data stay where they are but gain metatags, allowing researchers elsewhere to access them. Successful implementations of federation strategies in biotech will have implications for how all businesses store and access data— centralization may not be the best solution.

Occam's Revenge

Soc004

Occam's razor, in the commercial environment, means that the simplest technological solution is frequently the best. Occam's Revenge belongs to companies that undercut the market position of complicated products with simple solutions.

Insights

| The Future of Electronic Marketplaces | View summary |

| D03-2418 | |

|

Electronic marketplaces for business-to-business commerce were all the rage between 1998 and 2000. But the dot-com crash saw the demise of hundreds of start-ups that had sought to remedy market inefficiencies for buyers and sellers in exchange for presumably lucrative transaction fees. Even the consortium-based marketplaces that Global 2000 companies set up in response to the marketplace boom have struggled, with some shutting down in the past two years. This study reviews what happened during the marketplace boom, examines what caused the failure of so many marketplaces, and explores the role that commercial exchanges will play as companies gain experience and the technology evolves. It also surveys some longer-term developments that will affect how companies use electronic marketplaces in the future. Author: David Rader and the SRIC-BI Digital Futures research team. 22 pages. Index Keywords: Electronic Commerce; Internet; Intranet; Logistics. |

|

| Biotechnology: Industry Inflection Point or Investment Bubble? | View summary |

| D03-2419 | |

|

The late 1990s saw investors deploy capital with abandon in the life sciences. However, funding levels took a sharp downturn in the second half of 2002 as investors became more risk averse in the uncertain economy. Some people fear that a biotechnology bubble is in the making. Yet, at the same time, the biotech industry appears to be at a point of maturation: Its healthy product pipeline, revenue base, and level of partnership funding put the industry in a strong position for future growth. The challenge for investors and industry watchers is to identify opportunities and make the right investment decisions amid growing risks and unknowns. Investors note that, given the growing risks of pharmaceutical development, only a few companies will successfully make a successful transition from laboratory to market through internal product development. And they realize that they must avoid overestimating the short-term impact of emerging technologies and underestimating the long-term impact. Biotech companies, for their part, need good science, strong intellectual capital, and effective management to attract the investment capital they need. Author: Andrew Broderick. 12 pages. Index Keywords: Biotechnology; Health Care; Pharmaceutical Industry; Product Development. |

|

| Enterprise Portals: Emerging Adoption Patterns | View summary |

| D03-2420 | |

|

Public and private companies see portal technology as an opportunity to improve the delivery of information to customers, employees, and business partners—at a lower cost than is possible with the scattered approach that has typified most companies since the first networking of PCs in the 1980s. Today, the majority of Global 2000 companies have deployed or are developing portals. However, most of these portals are relatively unsophisticated and are far from meeting their full potential. Whereas the current focus is to consolidate Web investments into an organized and scalable framework, the ultimate vision for enterprise portals is to become a customized environment for solving problems in real time. For enterprise portals to reach this level of sophistication, developers and portal managers need to tackle two main hurdles: Define the proper use and focus of portals in their organizations, and find simpler ways of integrating applications into their portal frameworks. Author: David Rader. 11 pages. Index Keywords: Computer Services; Computer Software; Information Management; Information Technology; Internet; Intranet; Knowledge Management. |

|

| Lessons in eLearning from the Oil and Gas Industry | View summary |

| D03-2421 | |

|

The oil and gas industry is a global, highly competitive, and knowledge-intensive business with high demand for eLearning. This study provides an industry case study of the oil and gas sector and draws out implications for eLearning practitioners in other industries. Case studies of Shell, BP, and Statoil illustrate key implications and issues for companies considering or implementing learning-on-demand initiatives. The oil and gas industry has led the way in knowledge management for many years and is now adding eLearning to its knowledge and learning strategies. The large scale of implementations and the high level of innovation in oil and gas companies provide a variety of lessons and best practices for other industries. The best practices and agenda items that the study identifies include:

|

|

Calendar

Scan™ Briefings

The 2003 biannual Scan™ Briefings in which Scan staff present Scan analysis and findings in Menlo Park, California, will take place on:

- 22 May 2003 at 9:00 am

- 23 October 2003 at 9:00 am

Scan™ Abstract Meetings

Scan abstract meetings (in which SRIC-BI [now SBI] staff participate in a free-form discussion of current Scan abstracts) are open for client observation/participation on:

- 22 January 2003 at 9:00 am

- 19 March 2003 at 9:00 am

- 21 May 2003 at 1:30 pm

- 23 July 2003 at 9:00 am

- 17 September 2003 at 9:00 am

- 22 October 2003 at 1:30 pm

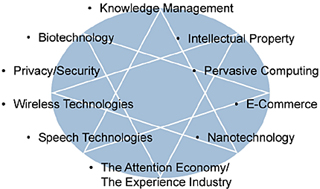

Watch List

The Scan program's scanning and research processes identify areas on the periphery of your organizations's focus that constitute potential opportunities or threats. The areas that we decide bear watching go on Scan's watch list of defining forces that are transforming the business environment. Current watch-list topics include: