New Carbon-Capture Opportunities Featured Signal of Change: SoC1091 June 2019

Capturing carbon dioxide (CO2) emissions from power plants and the atmosphere could become a booming industry in the coming decade. Global fossil-fuel use continues to climb, and energy-related CO2 emissions reached a record-high level in 2018. The world is already seeing the consequences of 1°C of global warming, including extreme weather events and rising sea levels. An October 2018 special report by the Intergovernmental Panel on Climate Change (IPCC; Geneva, Switzerland) warns that to prevent much more devastating consequences, governments need to limit warming to 1.5°C by slashing CO2 emissions by 45% (relative to 2010 levels) by 2030 and reaching zero net emissions by 2050. Investments in sustainable-energy technologies will need to take priority, but investments in carbon capture and storage (CCS) will likely be necessary as well.

Capturing carbon dioxide (CO2) emissions from power plants and the atmosphere could become a booming industry.

The International Energy Agency (IEA; Paris, France) sees carbon capture, use, and storage as a massive untapped opportunity. Although commercial use of carbon-capture technology began in the 1970s, the technology has seen minimal deployment since then because of its high costs and a lack of policy drivers. The Global CCS Institute (Melbourne, Australia) believes that because more governments are setting favorable policies and new investments are moving forward, the CCS industry has reached a turning point. For example, 45Q tax credits in the United States incentivize carbon capture and may enable the industry to scale up: Companies that capture and bury CO2 receive $50 per tonne, and companies that use CO2 in a productive way receive $35 per tonne. Using captured CO2 for enhanced oil recovery (EOR) is the most common practice today and is especially lucrative. And in early 2019, the European Commission announced the Innovation Fund, which will use about €10 billion to support low-carbon technologies by, for example, funding demonstration projects for CCS, energy-storage, and other technologies. The IEA estimates that offering $40 per tonne of CO2 as a commercial incentive "could trigger investment in the capture, utilisation and storage of up to 450 million tonnes of CO2 globally" (www.iea.org/topics/carbon-capture-and-storage/policiesandinvestment). Although prices on the European Union's carbon-emissions trading system have not reached this price, they did reach a ten-year high of €27 per tonne ($30 per tonne) in April 2019.

Carbon-capture technology is most effective when in use at locations with high concentrations of CO2 emissions—fossil-fuel-power plants, for example. NRG Energy (Princeton, New Jersey, and Houston, Texas) and JXTG Nippon Oil & Energy Corporation (JXTG Holdings; Tokyo, Japan) operate the Petra Nova project, which uses traditional absorption technology to capture carbon emissions at a large coal-power plant in Thompsons, Texas. Petra Nova is economically viable because of tax credits and revenues from EOR. New carbon-capture technologies are also in development. In 2018, Net Power—a joint venture by McDermott International (Houston, Texas), Exelon Generation (Exelon Corporation; Chicago, Illinois), 8 Rivers Capital (Durham, North Carolina), and Oxy Low Carbon Ventures (Occidental Petroleum Corporation; Houston, Texas)—reached first fire of a novel supercritical carbon dioxide (sCO2) power plant in La Porte, Texas. The plant's sCO2 power cycle can produce low-cost electricity from natural gas and includes full CO2 capture with near-zero emissions. Net Power hopes to develop several full-scale 300-megawatt plants by 2021, taking advantage of high demand for CO2 for use in EOR to drive commercialization. And scientists at Oak Ridge National Laboratory (Oak Ridge, Tennessee) recently demonstrated an energy-efficient process that captures CO2 as a crystallized bicarbonate salt and releases it from the solid state, thereby eliminating the energy-intensive step of heating a liquid sorbent.

Some new technologies aim to remove carbon directly from the atmosphere. The concentration of CO2 in air is quite low, but direct air capture might become a part of climate-change solutions. In mid-2018, a team comprising scientists from Harvard University (Cambridge, Massachusetts) and Carbon Engineering (Squamish, Canada) reported the discovery of a direct-air-capture process that can remove a tonne of CO2 from the atmosphere for between $94 and $232. These costs are still high, but experts previously estimated that using direct air capture to remove a tonne of CO2 from the atmosphere would cost at least $600. Carbon Engineering implemented the direct-air-capture process at a small pilot plant it operates in Squamish, Canada, and the captured CO2 can see use to produce synthetic fuels such as gasoline and jet fuel. The company aims to build an industrial-scale plant by 2021 and is seeing success in raising funds, closing a round of equity financing in March 2019 with $68 million in investments.

Relying on revenues from the use of captured carbon in EOR and various hydrocarbon-production processes to improve the economic viability of CCS facilities is problematic from an environmental perspective, because such uses of captured CO2 offset the carbon-reduction impact. Oil-and-gas firm Equinor (Stavanger, Norway) has operated offshore carbon-storage projects at the Sleipner and Snøhvit gas fields for 20 years, although the volumes of CO2 in storage are quite low. Equinor also plans to begin an undersea project to store 400,000 tons annually of CO2 by-product from industrial sources in 2020 (and is considering carbon-storage-as-a-service models). Australia may soon become home to the world's largest geological-carbon-storage facility because of Chevron Corporation's (San Ramon, California) Gorgon Project—a huge liquefied-natural-gas (LNG) facility on Barrow Island. Chevron agreed to capture 80% of the CO2 emissions (3.4 million to 4 million tonnes per year) from the underwater natural-gas field during a five-year period and to inject the emissions into a 2-kilometer-deep reservoir. Although the project began producing LNG in 2016, various issues have prevented it from commencing the carbon-capture-and-storage process.

New circular-carbon technologies could bring about a new era in the way the world uses captured CO2 emissions. Sponsored by NRG Energy and Canada's Oil Sands Innovation Alliance (COSIA; Calgary, Canada), the XPrize Foundation's (Culver City, California) NRG COSIA Carbon XPrize (www.xprize.org/prizes/carbon) is a four-and-a-half-year global competition to demonstrate new technologies. In 2018, judges selected finalists to convert CO2 emissions into useful products at a coal-fired power plant in Gillette, Wyoming, and at a natural-gas-fired power plant in Alberta, Canada.

Fossil-fuel companies will very likely see growing pressure—including lawsuits—from governments, investors, and environmentalists to reduce carbon emissions. CCS technology may become crucial to the viability of coal-based power generation. Oil majors are also facing a carbon-constrained future. For example, Royal Dutch Shell (The Hague, Netherlands) and BP (London, England) recently announced plans to link executive pay to meeting short-term carbon-emissions targets. As social and economic harm from global warming increases, decarbonization efforts may accelerate.

The Development of this Signal of Change

Data Points

- SC-2019-07-03-061

Carbon Engineering aims to build an industrial-scale plant by 2021 and is seeing success in raising funds, closing a round of equity financing in March 2019 with $68 million in investments. - SC-2018-10-26-037

Equinor plans to begin an undersea project to store 400,000 tons annually of CO2 by-product from industrial sources in 2020. - SC-2018-07-11-045

The NRG COSIA Carbon XPRIZE selected finalists to convert CO2 emissions into useful products at a coal-fired power plant in Gillette, Wyoming, and at a natural-gas-fired power plant in Alberta, Canada.

Implications

New Carbon-Capture Opportunities

Capturing carbon dioxide (CO2) emissions from power plants and the atmosphere could become a booming industry.

Previous Alerts

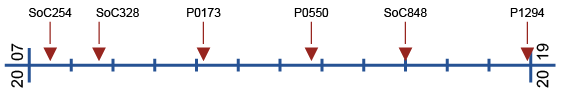

- SoC254 — Timing Is Everything in Going Green (July 2007)

Public interest clearly exists in "greening" the energy and manufacturing sectors, and new technologies make affordable, clean practices seem within reach. - SoC328 — Carbon Labeling Needs Standards (September 2008)

Governments, manufacturers, and retailers have launched carbon-labeling efforts across the globe to document the carbon dioxide emissions associated with particular products. - P0173 — Local Responses to Environmental Issues (March 2011)

An increasing number of individual nations, states, and communities are acting autonomously to tackle local or regional issues. - P0550 — Energy-Industry Transformations (October 2013)

Across all major energy sectors, new energy technologies are emerging that have the potential to alter global energy systems significantly while reducing carbon emissions. - SoC848 — Fossil-Fuel Headwinds (January 2016)

Many governments in developed countries are setting a course toward the use of renewable energy at the expense of fossil fuels. - P1294 — The Case for Carbon Capture (December 2018)

Carbon capture is moving from the sidelines to become an environmental necessity with a growing business case.