Who Hails Taxis? Who Taps Apps (for Ridesharing)? April 2017

Uber, Lyft, and other app-based ridesharing services are in the news and on the streets competing with traditional taxis—much to taxi drivers' dismay. Taxis' concerns about losing revenue and market share to ridesharing raises the question "Who is using rideshare services, and are those people different from the people who use taxis?"

Taxi companies still lead ridesharing services in numbers of served customers, according to GfK MRI US national survey data showing that approximately 3,173,000 US adults (1.31%) use taxis on an average weekday, in comparison with about 863,000 people (0.36%) who use ridesharing services. However, Uber, in particular, is pushing aggressively to expand in new US cities and around the world. Uber's market share in New York City grew from 4% to 14% between 2014 and 2015. It has established partnerships with major automobile companies and is at the top of Fortune's 2016 Unicorn List—private companies valued at $1 billion or more. Lyft and countless others are working to expand their services, as well.

Taxi

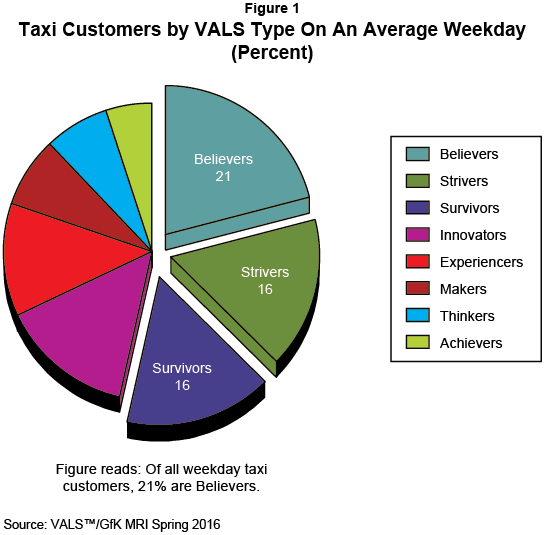

As Figure 1 shows, somewhat more than 50% of taxis' weekday passengers are Believers, Strivers, and Survivors. Believers and Survivors are the two most traditional US consumer groups, preferring to stick with familiar and time-tested brands and ways. Both groups are uncomfortable in trying new or innovative products or services. They follow established routines and like the idea that they do what most regular people do. Believers and Survivors are unlikely to shift to ridesharing app-based services until they are convinced that everybody else is doing so. Interestingly, in spite of the fact that 80% of Believers own smartphones, they do not report downloading or using apps. The Survivors group is the least likely US consumer group to own smartphones and does not use apps, either. App hailing is a hallmark of rideshare services. Given the attitudes and behaviors of Believers and Survivors, it is not surprising that they are sticking with taxis.

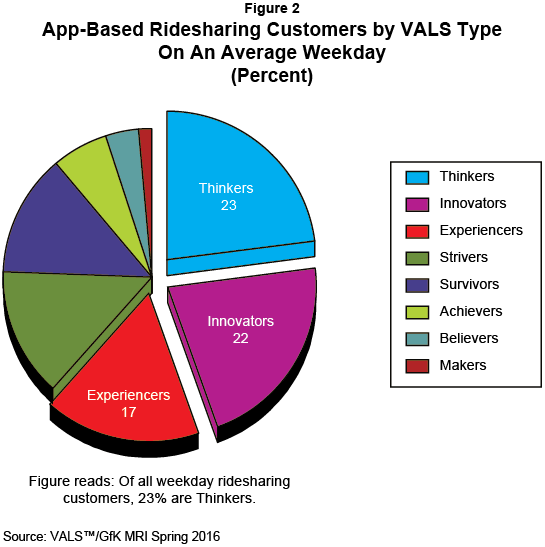

Strivers, by contrast, are not traditional people, so why do they still make up the second-largest percentage of taxis' weekday riders? We don't know for sure without investigating the issue in greater detail. It may have less to do with their attitudes about innovation and more to do with lack of access. Simply put, fewer ridesharing services may be available in poorer urban or suburban neighborhoods were many Strivers live. In a long-standing effort to prevent racial discrimination in transportation, cities regulated taxi companies, making it illegal to refuse ride requests on the basis of geographic desirability or to refuse people hailing rides from the street. But these regulations don't apply to ridesharing services in most cities—at least, not yet. Evidence that people (including Strivers) living in poor neighborhoods are underserved by Uber and Lyft is a highlight in two studies by the American Public Transportation Association and the Eno Center for Transportation. Many Strivers come from families with lower-than-average levels of household income, education, real estate ownership, and inherited assets. As a consequence, younger Strivers often end up with less education, fewer job skills, and lower levels of full-time employment, in spite of their best efforts. Therefore, they often continue to live in poor neighborhoods underserved by ridesharing. If access were less of an issue, Strivers would likely switch from taxis to ridesharing more quickly than would Believers or Survivors living in the same neighborhoods. Strivers are active users of social media and familiar with popular culture and trends, and many are likely already aware of ridesharing, even if they haven't used it yet. Some Strivers, however, are ridesharing; they are already the fourth-largest percentage of ridesharing weekday users, as Figure 2 shows.

Rideshare

Thinkers (23%) and Innovators (22%) make up nearly 50% of rideshare weekday users, as Figure 2 shows. The Experiencers group, the youngest VALS group, with a median age of 24, makes up the next-largest proportion today: 17% of rideshare users. Innovators and Experiencers tend to be the groups that are both the most interested in and the most willing to try and to buy items that are new. Unfortunately, Experiencers' enthusiasm is often curbed by high price tags, but this damper isn't an impediment for ridesharing, whose costs are on par with traditional taxi fees. Both Innovators and Experiencers are technologically savvy groups interested in eliminating slow, laborious ways of doing activities. They are both active smart phone users with an array of apps for a wide variety of practical and entertainment-related purposes. Social and adventure-seeking Experiencers may especially appreciate the possibility of becoming friends with a ridesharing driver or fellow passenger (as in Lyft's carpool option). Given the forward-thinking mind-set of Innovators and Experiencers, the appeal of ridesharing makes perfect sense.

Somewhat surprisingly, Thinkers make up a fifth of today's rideshare users. Their interest in and knowledge of innovative services often lags their actual use of the services. Thinkers often follow behind Innovators and Experiencers in the adoption of new products or services, waiting until the bugs are worked out, the pricing falls, and the practical, functional value to their specific lives is in evidence. The MRI GfK data indicate that Thinkers are seeing ridesharing benefits, some of which might include the convenience of hailing a ride from their own smartphone, the time savings of prompt driver arrival, the ease and seamless nature of cashless payment, and the various information features such as the ability compare price points and arrival times for route options easily or to let family or friends track their ride on their own remote phones or tablets.

If ridesharing services continue to integrate innovative technologies and features such as surge pricing and driverless cars, they will likely attract larger numbers of Innovators, Experiencers, and Thinkers; Believers and Survivors will likely remain loyal to traditional taxi companies. Strivers are likely to continue shifting over to ridesharing and might do so faster if access to it improved. Achievers, not previously in the discussion, make up small proportions of taxi and ridesharing-service customers today, which we hypothesize has to do with two key Achievers behaviors: their likelihood of having children at home and their high levels of car ownership. Together, these behaviors may indicate their preference for self-controlled transportation evident in their driving their own cars.