A Retail Tale August 2017

In the first quarter of 2017, "Roughly 2,880 retail stores in the U.S. have closed," according to Oz.com; CNN.com reports 3,300 store closings so far in 2017. Excessive retail space—7.3 square feet per capita—and the rise of ecommerce are the most-often-cited reasons for retail contraction. "How overstored is a question we won't be able to answer until we understand how much business is being transferred online," comments one retail analyst. Retailresearch.org projected the US share of online retail to be 13.9% in 2016. Some analysts predict online sales will account for as much as 50% of all retail sales by 2030.

To help understand how the marketplace is evolving, we look at two retail titans: Walmart and Amazon.com. One is a brick-and-mortar operation with a retail website; the other is a web-based retail operation. However, both have broad consumer reach, offer a wide variety of merchandise, and are known for competitive pricing.

Walmart

Walmart is known for having low, everyday pricing. Founded in 1962, Walmart is the number 1 company on the 2017 Fortune 500. With 4,723 retail stores (excluding 600 Sam's Clubs), Walmart is the largest single employer in America. The United States represents the lion's share of Walmart's net sales. Between 2008 and 2016, the company's overall net revenue increased from $238.9 billion to $298.4 billion, according to Statista.

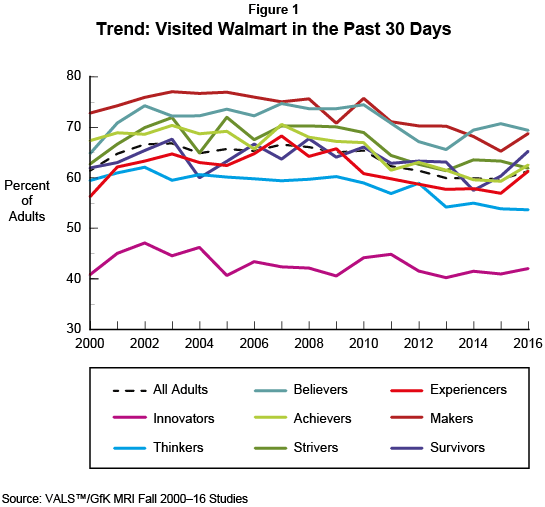

Between 2000 and 2016, the percent of adults who have visited one or more Walmart stores in the past 30 days remains unchanged at 61%. The US adult population has grown by 44 million during the same period. However, the number of adults visiting Walmart has increased by only 26.6 million (from 123.3 million to 149.9 million): Walmart's store traffic is not keeping pace with population growth.

Walmart has invested heavily in its web presence. In 2016, Fortune Magazine reported that Walmart was the second-largest online US retailer. In May 2017, Walmart reported that in the first quarter, "its e-commerce sales grew 63 percent year over year." Thanks in part to Walmart's $3.3 billion acquisition of Jet.com in 2016, the retailer now boasts that it offers 50 million items online—five times the number of items it offered a year ago.

Despite aggressive investments, Walmart online is playing catch-up to Amazon.com. VALS™/GfK MRI's Survey of the American Consumer shows that as of fall 2016, only 12% of US adults visited Walmart.com in the past 30 days, in comparison with 41% of adults who visited Amazon.com. Walmart's recent customer perks of more healthful food choices (costing more money) and curbside pickup of online orders may not translate to significant revenue or profit increases. Walmart's success will depend on how well its offers match its customer base, the online growth it can reasonably expect from its base, and the acquisition of Amazon customers. Customer acquisition is always expensive.

Walmart Customers

With a foundation built in serving rural America, Walmart's core customers are Believers and Makers, followed by Survivors. These three groups are the most likely to have visited a Walmart store in the past 30 days. All three are low-resource VALS consumer groups. Many live in areas where the number of retailers is limited. Overall, the groups are in middle age or older with limited discretionary income. They look for low prices on needed items. To date, few are online shoppers.

Economical Believers shop for needed items; not for recreation. Most enjoy shopping because doing so fulfills their desire to provide a comfortable, happy, well-run home for their family. A Walmart "greeter" offers a friendly, personal welcome to the store. The assurance of low price and wide selection provides Believers with many product choices. Believers look for sharp pricing on me-too fashion apparel and home-goods item in easy-care fabrics and finishes. The convenience of one-stop shopping has strong appeal; the need for multiple shopping trips, or the need to interact with unfamiliar retailers, does not. Believers are typically uncomfortable in one-to-one sales situations because they feel pressured to buy.

Makers don't like to shop and, in fact, they shop only when they can't buy secondhand items, build, make, grow their own, or have someone shop for them. Exceptions to this rule may be items typically in Walmart's automotive, sporting goods, and home-improvement aisles. Clothing and shoe areas see infrequent visits even for basics such as T-shirts, work pants, and boots. Price, not fashion is the consideration. Makers want to move in and out of a store as quickly as possible, because to them, shopping is a waste of time—they have better, more interesting things to do. One-stop shopping and the ability to stock up on household items such as laundry detergent and paper products are boons.

Economically constrained Survivors have minimal wants and needs other than for food and pharmaceuticals. They look for trusted brands at low prices. Clothing and shoe purchases are infrequent and practical. The store greeter offers a welcoming entry to a world of products almost beyond their ability to comprehend. Although they appreciate a no-pressure-to-buy retail environment, many may want help to find what they look for. Survivors are more likely to buy what they need immediately rather than to stock up on items for the future because of fixed budgets, limited storage space, or their ability to transport a quantity of goods home. Survivors want to preserve what they have, not change, redo, or acquire more.

Amazon.com

Amazon.com is known for being a smart, convenient way to shop. Founded in 1994, Amazon ranks number 4 on Business Insider's list of most powerful companies in the United States. North America accounts for the majority of Amazon's net revenue. Between 2006 and 2016, Amazon's overall net US sales revenue grew from $5.7 billion to $80 billion, according to Statista. In market capitalization, Amazon recently surpassed Walmart as the most valuable retailer in the United States. In late May 2017, CNBC reported that Amazon stock had reached an all-time high of $1,000 a share.

Amazon is well positioned to continue to transform retailing through attractive pricing and home delivery. Amazon offers an amazing range of merchandise—from appliances to vehicles and wine—with traditional retailer services such as gift cards and a gift registry. In many categories, Amazon's 40 subsidies offer specific types of products and services, such as shoes (Zappos), women's fashion (Shopbop), and books (Goodreads). Innovations in consumer electronics (Kindle, audiobooks, and Alexa-enabled Echo—a voice-enabled Wi-Fi speaker) and publishing tools and services for authors, movie studios, and music labels are hallmarks of Amazon's new and exciting brand of retail. Ever expanding, Amazon now competes directly with Netflix in original programming. In 2014, Transparent (Amazon's first blockbuster hit) won two Golden Globe awards; Man in the High Castle and Mozart in the Jungle have also won acclaim.

The shopping experience becomes even better with an annual Amazon Prime membership ($99). Subscribers receive free two-day shipping, exclusive access to movies and TV shows, ad-free music, unlimited photo storage, and Kindle books. Other than promising direct experiences such as a meal, travel to an exotic locale, or participation in an exciting event or activity, Amazon promises a world of choice from the comfort of home—no traffic, parking hassles, checkout lines, or phone-tree hell. By keeping its promise, Amazon continually builds customer trust that translates to increased revenue and profit for the company. As of May 2017, "Amazon's valuation of $464 billion is now twice that of Walmart," reports the New York Times.

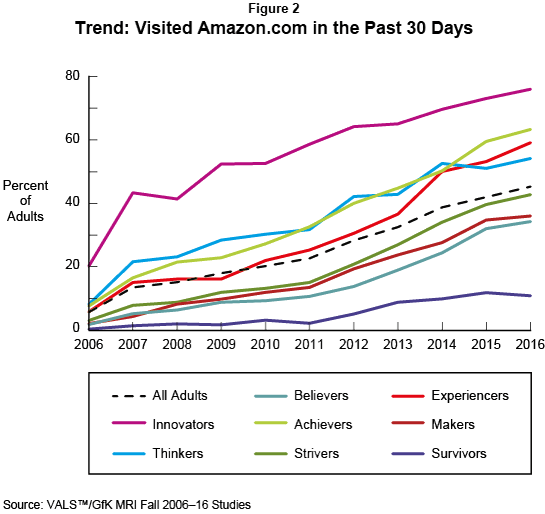

In 2016, Amazon.com generated more traffic in the past 30 days than any brick-and-mortar retailer except Walmart. Between 2006 and 2016, the percent of US adults who have visited Amazon has grown from 6% to 45%—from 12.5 million to 109 million visits.

Amazon Customers

Innovators are early adopters because they are interested in new ways to accomplish tasks and are the most willing to experiment. Innovators (76%) are more likely than all adults (41%) or any other consumer group, to have visited Amazon in the past 30 days. Innovators gravitate to online shopping not only for its convenience and time savings but also because of the unlimited number of available choices. The combination of Amazon's broad selection, 24/7 accessibility, timely delivery, and deft management of customer expectations wins Innovators' approval and loyalty. Freed from mundane shopping, Innovators are able to enjoy interesting and rewarding in-store shopping experiences once again.

Contact us to learn more about Innovators and the experience-market revolution.